Andi: ‘Global Value Chain’ Opportunities Opening for Colombia: Part One

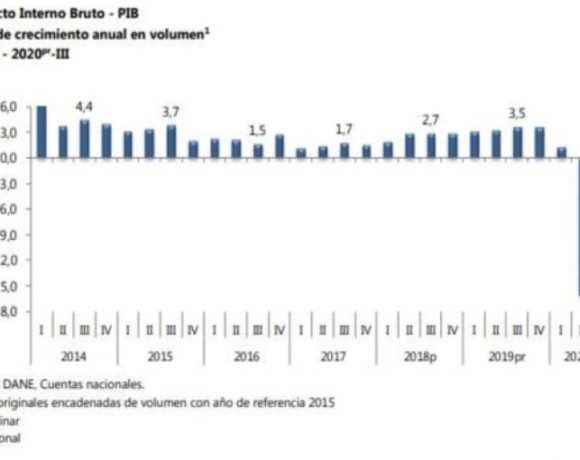

Colombia’s economy still suffers a hangover as the oil-and-mining boom of the prior six years has predictably turned to bust, according to a new study for Medellin-based Andi, Colombia’s national industrial trade association.

But a falling Colombia peso (COP) versus the surging U.S. dollar – combined with the possible emergence of a smarter, strategic tax-and-regulatory regime — could cure the hangover and get the country back on track for robust economic growth.

Today, the country’s industrial producers — and its government — are trying to recover from the classic “Dutch disease” caused by surging oil-related dollar inflows and a consequent rise in the Colombia peso (COP).

That currency revaluation hurt other Colombian export sectors including many manufactured goods and major agricultural products, including coffee and cut flowers.

But as global oil, coal and gold prices plummeted, the U.S. dollar has strengthened by nearly 70% versus the COP.

Result: Colombia’s exports of both manufactured goods and agricultural products are looking more profitable. Latest government statistics reveal that following years of deterioration, Colombia’s industrial sector is starting to show signs of renewed vigor.

However, the newly favorable COP/dollar exchange rate won’t solve all the problems facing exporters, according the Andi study.

One reason: the strengthening U.S. dollar has boosted the cost of certain raw materials and imported machinery for some of Colombia’s export-oriented manufacturers. So, the dollar appreciation – while mostly favorable — isn’t just one-way street.

Structural Changes

Beyond analyzing currency fluctuation impacts, the Andi study also highlights a series of structural reforms as well as strategic moves that entrepreneurs need to take in order to refocus industrial production on the fast-moving “global value chain” (“CVG” in Spanish acronym).

By tapping into the growing, globally based chain of manufacturing and distribution (often involving collaborations with foreign companies), Colombia’s entrepreneurs could climb aboard a profitable, upward escalator, instead of falling into the downward, protectionist trap typified by the failed import-substitution policies of the pre-1990 era, the study shows.

Such obsolete protectionist schemes are still promoted by left-wing politicians in Colombia (including certain members of Polo Democratico). Anti-gringo, protectionist rhetoric similarly is employed by narco-terrorist groups FARC and the ELN as a phony façade for their extorsions, murders, kidnapping and drug trafficking.

The protectionist years only resulted in extremely limited, costly choices for consumers — in everything from cars to foods — and strangled innovation, while benefiting mainly those with certain political connections.

Fortunately for most Colombians, the reactionary left-wingers and the “anti-imperialist” fakers only represent a minority on the national political scene.

Result: Rather than retreating into the past, Colombia has for 25 years been opening its doors to new, better, broader and cheaper products and services from around the world.

However, to keep its industrial economy in balance, Colombia also needs to expand its “CVG” industrial and agricultural-related export opportunities, rather than over-reliance on oil and mining exports, the Andi study shows.

Recent free-trade agreements (FTAs) are starting to open those doors of opportunity.

Besides the recent FTAs with the U.S. and the European Union, Colombia also now has FTAs with Canada, México, El Salvador, Guatemala, Honduras, Chile, Nicaragua, Cuba, the Carribean nation members of Caricom, the Mercosur nations including Argentina and Brazil, and the EFTA nations including Iceland, Liechtenstein, Norway, and Switzerland, the Andi report notes.

Meanwhile, FTAs already negotiated and awaiting entry-into-force include those with South Korea, Costa Rica, Israel and Panama. Japan also is now negotiating its FTA with Colombia.

As a result of these agreements, Colombia’s FTA deals now cover nations representing 70% of the world’s global economic output, 65% of global commerce and 60% of the world’s potential exporters to Colombia, the study notes.

Boosting exports to those global markets, however, will require strategic and government policy changes, the Andi study shows.

Next/Part Two: Andi’s ‘New Industrialization’ Scheme