Bancolombia 2Q 2021 Profits Dramatically Improve Year-on-Year

Medellin-based multinational banking giant Bancolombia announced August 11 that its second quarter (2Q) 2021 net income rose to COP$1.2 trillion (US$312 million), up from a COP$73 billion (US$19 million)net loss in 2Q 2020.

“This profit represents a growth of 113% compared to 1Q 2021 and a significant recovery from the net loss presented in 2Q 2020,” according to Bancolombia.”

The corporate loan book rose 3.25% quarter-on-quarter, while deposits were up 2.82% net loan-provision charges dropped 51%.

Meanwhile, Bancolombia’s client base continues to grow at a 10% annual rate over the last five years, according to the company.

Thanks to investments in technology, “85% of total transactions are done through digital channels” rather than inside bank branches, according to the company.

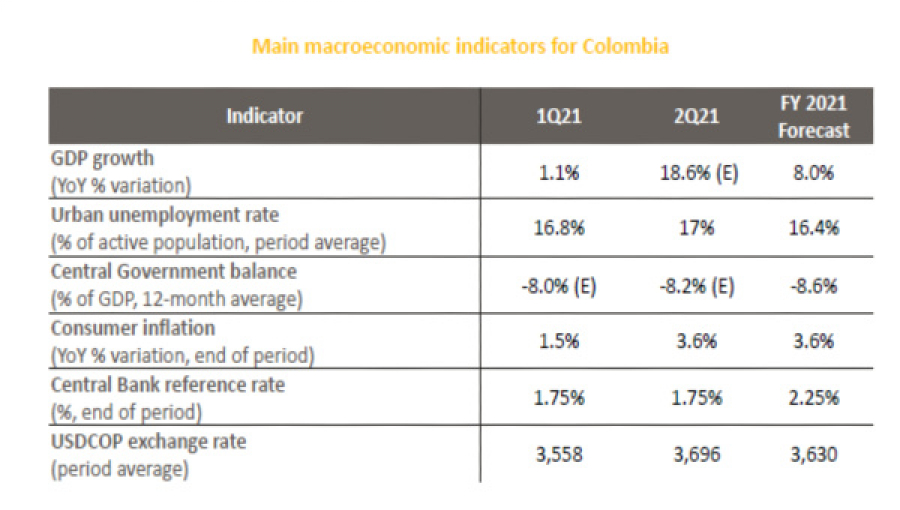

“Despite a challenging context, the recovery in economic activity continued in 2Q 2021. Hence, we adjusted our fiscal 2021 GDP forecast [for Colombian economic growth] to 8%. We expect that the revised fiscal reform that the government submitted to Congress last month will be approved during this semester,” the company added.

While overall net income improved year-on-year, net interest income nevertheless dipped 1.9% year-on-year, to COP$2.84 trillion (US$739 million), according to the company.

In addition, “interest-rate derivatives and our repos portfolio generated COP$273 billion (US$71 million), 40.7% lower when compared to 1Q 2021,” according to Bancolombia.

Annualized net interest margin also dipped slightly, “due to the lower allocation of resources in foreign currency securities and their respective exchange rate restatement.

“Additionally, the profitability of investments in fixed income assets and their derivatives decreased, explained by lower valuations in a scenario of expected changes in Colombian monetary policy for the upcoming months,” the company added.

On the other hand, “total funding cost continues to show a better performance during 2Q 2021. Savings accounts and checking accounts have increased their share over the last 12 months. Savings accounts represented 36% in 2Q 2020, and 42% of total funding for 2Q 2021.

“The annualized average weighted cost of deposits was 1.45% in 2Q 2021, dropping 12 basis points compared to 1Q 2021 and 103 basis points compared to 2Q 2020,” according to Bancolombia.

Meanwhile, net fees and income from services totaled COP$807 billion (US$210 million), up 18% year-on-year.

“The better annual performance in fees is mainly due to higher volumes of transactions, denoting too the positive results on commission income for credit and debit cards and commercial establishments, payments and collections as well as banking services,” according to the company.

“Fees from credit, debit cards and commercial establishments went up by 2.1% compared to 1Q 2021 and by 33.4% compared to 2Q 2020,” while fees from asset management and trust services rose 16.8% compared to 2Q 2020.

Past-due loans (overdue more than 30 days) totaled COP$9 trillion (US$2.3 billion) at the end of 2Q 2021 and represented 4.6% of total gross loans, while charge-offs totaled COP$988 billion (US$257 million).

Coverage for past-due loans was 169% at the end of 2Q 2021, down from 171.7% at the end of 1Q 2021.

“Provision charges (net of recoveries) totaled COP$626 billion (US$163 million) in 2Q21. The provisions reduction during the quarter were mainly due to macroeconomic impacts considering a better outlook in the models for 2021 compared to previous estimates, to adjustments in the provisioning rules for the portfolio under credit reliefs and to a lower deterioration in retail and small-and-medium enterprise customers,” according to Bancolombia.

“Bancolombia maintains a strong balance sheet supported by an adequate level of loan loss reserves. Allowances (for the principal) for loan losses totaled COP$15 trillion [US$3.9 billion], or 7.7% of total loans at the end of 2Q 2021, decreasing when compared to 1Q 2021,” according to the company.

As of March 31, 2021, Bancolombia had 30,993 employees, 933 banking branches, 6,018 ATMs, had 21,876 banking agents and served more than 20 million customers, according to the company.