Colombian Industry Growing Despite Oil-Price Crash

The latest annual “joint industrial opinion survey” (JIOS) organized by Medellin-based Andi (Colombia’s national industrial trade association) shows that Colombia’s industrial sector continued to grow in 2015 despite the global oil-price crash that has crippled its oil-dependent neighbors.

The JIOS for full-year 2015 “reflects a slight increase in both production and sales” among Colombia manufacturers, according to Andi.

Positive factors for Colombian industry include the impending start-up of the massive “fourth generation” (4G) highway construction projects and “progress in the discussion of structural reforms that the country so badly needs,” according to Andi.

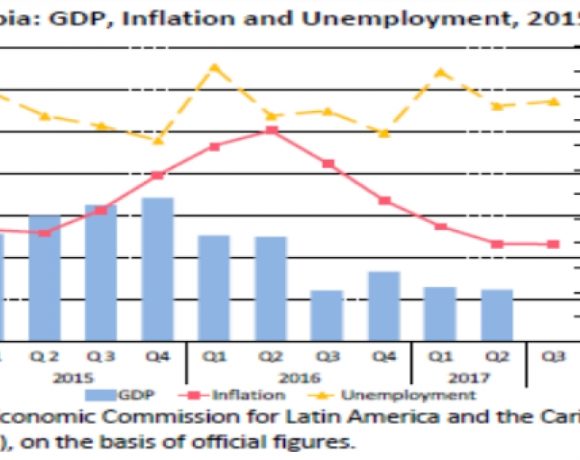

Despite these positive events, “we cannot underestimate the impact of the collapse in oil prices on public finances; the phenomenon of the El Niño (drought); difficulties in neighboring countries and in general the uncertainty of the global economy,” according to the trade group.

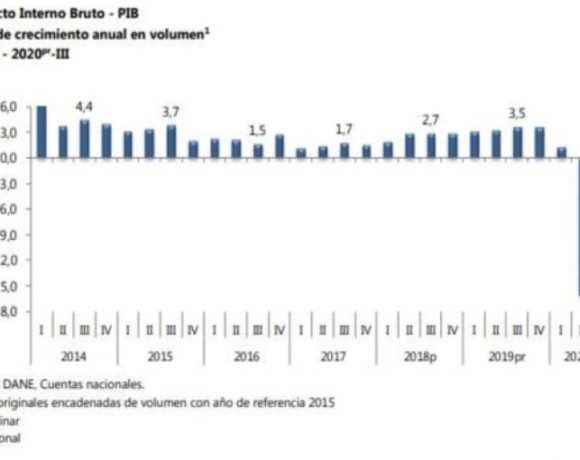

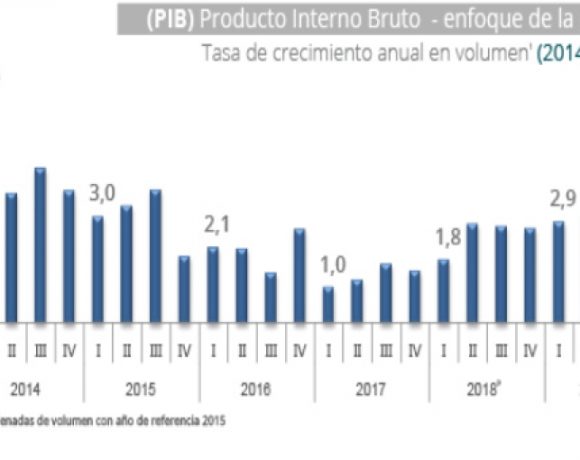

Even in the face of such problems, “Colombia stands out among economies not only in Latin America but in the world, ending 2015 with a [growth] rate of slightly above 3%,” the result of Colombia’s capitalistic, democratic policies that have won praise from the International Monetary Fund and the World Bank, Andi noted.

Manufacturing sector growth was hurt during most of 2015 because of a temporary shut-down of the just-reconstructed, 170,000 barrels per day Reficar oil refinery in Cartagena, the trade group pointed out.

The collapse in oil prices hurt Colombian exports in 2015, while “high logistics and transport costs, smuggling [and] informality” also hurt industrial growth, according to Andi.

“However, it is important to note that in the last few months, indicators have shown signs of [industrial] recovery as the 2015 figures ended in positive territory,” according to the group.

Similarly, customer orders for manufactured goods have now risen “above the historical average” and manufacturers are now more optimistic about demand and profitability in 2016 compared to what they perceived six months ago, the survey found.

Colombian manufacturing generally out-performed the rest of Latin America with the exception of Mexico, the survey found.

In Colombia during 2015, industrial production increased 0.5% year-on-year, total sales rose 0.8% and domestic sales grew 2.9%. In contrast, Brazilian industrial production fell 9.9% year-on-year in 2015, while Ecuador manufacturing fell 2.4%, Peru declined 2.9% and Chile slipped by 0.6%, the survey noted.

For 2016, Colombian industry will continue to see a recovery in exports, as the sharp rise in the U.S. dollar versus the Colombia peso “has reopened some markets,” according to Andi.

What’s more, the recommissioning of the Reficar refinery early this year “not only constitutes a great opportunity for the mining and energy sector but also other sectors that are part of the value chain” that is tied to the oil-refining sector, according to the study.

However, Colombia still faces “internal difficulties resulting from the current-account deficit, the [government’s] fiscal situation and the impact of higher taxes on investment and growth,” Andi warned.

“From a macroeconomic point of view, the challenge is large — and the country’s stability depends on [fiscal] discipline that the government [must adopt], especially in the reduction of public spending,” according to Andi.

“On the external front, the main concern is low global growth, given that Europe is still recovering from the crisis; the United States still does not have a completely clear picture; the performance of emerging-market countries such as China and Russia [is cloudy]; and a complex situation [remains] in neighboring countries and trading partners such as Brazil, Argentina, Ecuador and Venezuela,” according to Andi.

While the rise in the U.S. dollar versus the Colombia peso generally aids exporters, it pinches Colombian manufacturers that import machinery, raw materials and dollar-denominated finance. As a result, the exchange rate is cited as the number-one challenge for Colombian manufacturers, followed by demand challenges, market competition, smuggling, logistics costs and low profit margins, according to the survey.