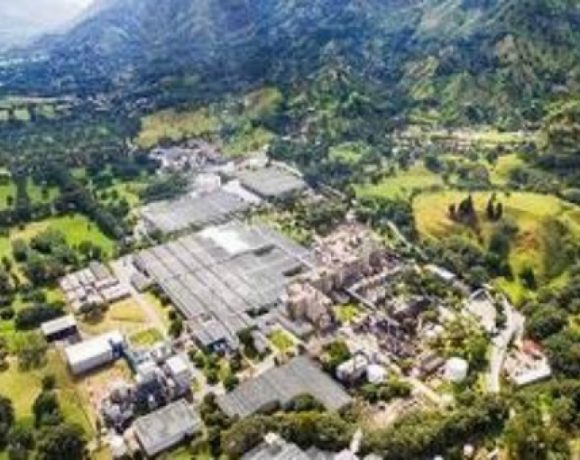

Construcciones El Condor Posts Net Loss for 2Q 2025

Medellin-based highway construction giant Construcciones El Condor on August 8 posted a second quarter (2Q) 2025 net loss of COP$209.8 billion (US$51.7 million) — 224% worse than the COP$64.7 billion (US$15.9 million) net loss in 2Q 2024.

Revenue from ordinary activities in 2Q 2025 totaled COP$492.6 billion (US$121.6 million), down 15% year-on-year, “equivalent to a drop in revenue of approximately COP$90 billion [US$22.2 million],” according to El Condor.

Earnings before interest, taxes, depreciation and amortization (EBITDA) for 2Q 2025 resulted in a net loss of COP$37.8 billion (US$9.3 million) — a sharp reversal compared to a positive EBITDA of COP$66.9 billion (US$16.5 million) in 2Q 2024.

Negative results in 2Q 2025 largely came as a result of “three extraordinary events,” according to El Condor:

- A total accumulated loss in 2025 of COP$132 billion [US$32.5 million] “corresponding to the results of the Ruta al Sur project.”

- A loss of COP$76 billion [US$18.7 million] “derived from the sale of the stake in the Pacífico 3 Concession.”

- A loss of COP$18.4 billion [US$4.5 million] “associated with the accounting recognition of the results of Vías del Nus (VINUS) under the equity method.”

“Excluding these extraordinary effects, adjusted net income, also discounting deferred tax effects, would be a negative COP$25 billion [US$6.17 million], with an adjusted net margin of -5.2%, reflecting a performance more aligned with the business operation,” according to El Condor.

El Condor also cited revenue declines resulting from “completion of the Magdalena 2 project, as delivery of the last functional unit under the company’s responsibility is scheduled for August 2025.”

Meanwhile, “the Ruta al Sur project has advanced with an average monthly revenue of COP$20 billion [US$4.9 million], which has been affected by external factors, such as adverse weather conditions and public order situations, including strikes and stoppages that have affected the southern region of the country.”

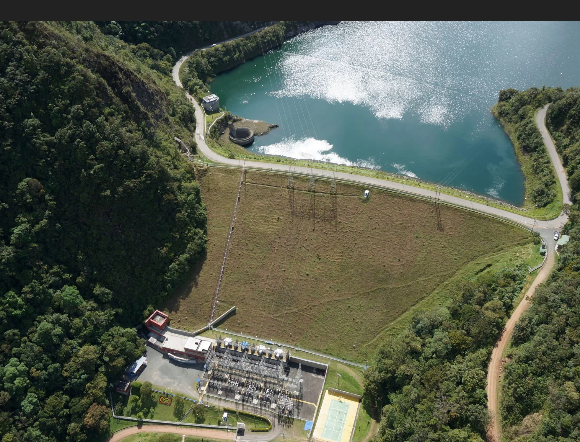

In addition, “revenue generated by the concessions business totaled COP$$17.3 billion [US$4.27 million], a figure that reflects a decrease compared to the previous losses, mainly explained by the sale of the Pacífico 3 Concession,” the company explained.

On a positive note, “interest expense as of June 2025 closed at COP$71.7 billion [US$17.7 million], representing a 24% decrease compared to the same period in 2024,” according to the company.

“The most significant event contributing to this reduction was the sale of the stake in the Pacifico 3 Concession, which allowed for a debt reduction of COP$423.76 billion [US$104 million]. This progress represents a key milestone in the deleveraging strategy and reflects the company’s commitment to meeting its financial obligations,” the company added.