Enka Full-Year 2022 Profits Drop 58% Year-on-Year

Medellin-based textiles and plastics-recycling giant Enka reported March 16 that its full-year 2022 net income dropped 58% year-on-year, to COP$24.6 billion (US$5.08 million).

Earnings before interest, taxes, depreciation and amortization (EBITDA) fell 29% year-on-year, to COP$54 billion (US$11 million).

The EBITDA decline was explained by “lower [sales] volume and difficulty of fully transferring higher material costs to sales prices, especially in the textile and industrial businesses,” according to Enka.

As for the net income decline, this came as a result of “lower operating income, the [Colombian peso versus U.S. dollar] exchange difference [for the domestic Colombia market] and higher financial expenses,” according to the company.

Gross revenues actually rose by 9% year-on-year, to COP$585.7 billion (US$121 million), from COP$534 billion (US$110 million) in 2021, “as a result of higher prices and international exchange rates [for export sales], which offset a lower sales volume,” according to Enka.

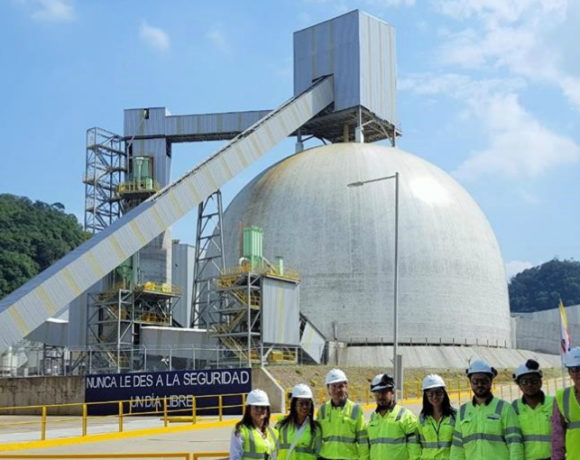

Despite the disappointing financial results, “Enka successfully completed its project for the new ‘EKO-PET’ [plastic bottle recycling] plant, complying with the estimated schedule and investment, which adds 24,000 tons of capacity and strengthens our leadership in the circular economy in Colombia,” according to the company.

“The year 2022 was a year of great challenges, especially due to the complex macroeconomic environment and disruptions in the supply of raw materials, mainly in nylon supply chain and electric power generation costs,” according to Enka.

“The company managed to offset some of this through supply diversification strategies, managing to standardize new suppliers and alternatives for raw materials for our nylon business and develop initiatives to use biomass to diversify our energy matrix.”

At year-end 2022, Enka’s total assets hit COP$808 billion (US$166.7 million), up COP$124 billion (US$25.6 million) from 2021.

The company credits those improvements to the new EKO-PET plant, working-capital hikes due to higher international prices, advanced purchases of raw materials to hedge the Russia-Ukraine conflict and a better tax situation.

Liabilities ended at COP$327 billion (US$67 million), up COP$106 billion (US$21.8 million) “due to the financing of higher inventories and financial disbursements for capex and inventories required for the new plastic-bottle recycling plant,” according to Enka.

“The index of net indebtedness ended at 3.5-times EBITDA, after having completed the investments in the new EKO-PET plant. With strategies implemented to diversify supplies, and realize sales from the new EKO-PET plant, we expect to reduce this indicator during 2023 in order to continue with the development of new growth projects,” the company added.

Sales abroad in 2022 rose 19% year-on-year, hitting US$60.7 million, representing 44% of total revenue. “Good behavior of the Brazilian markets and the market diversification strategy, especially in Europe, offset lower demand from North America, which showed some signs of slowdown in the second half of the year,” according to Enka.

“As a result, Brazil becomes the main export destination with 21% of sales, followed by North America with 16%,” the company added.

As for its “green” plastics-recycling products and markets, “the operating income of the green businesses grew by 27%, reaching COP$193 billion [US$39.8 million], or 33% of total sales, 86% of which correspond to sales in the local Colombian market, which reflects the high commitment of our customers with the environment,” according to Enka.

“The three recycling plants operated at maximum capacity in 2022, given the completion of the project for the new EKO-PET plant in the final quarter, whose technology has authorization from [Colombian sanitary standards regulator] Invima and the U.S. FDA [Food and Drug Administration], which allows access to both national and foreign markets.”

As for its “EKO-FIBRAS” textile line, “the development of new applications and markets for specialized sectors, such as geotextiles, automotive, cleaning and footwear, made possible an increase in the 72% in the consumption of post-consumer colored bottles, which have higher limitations for its recycling,” the company noted.

.

Meanwhile, the “EKO-Polyolefins” portfolio “was strengthened with the progress of approvals of our product with Dow Chemical, under its ‘Revo’ brand,” the company added.