Hidroituango Contractors Slam EPM’s COP$9.9 Trillion ‘Conciliation’ Demands; Wall Street Issues Warning Flag on Board’s Sudden Mass Exit

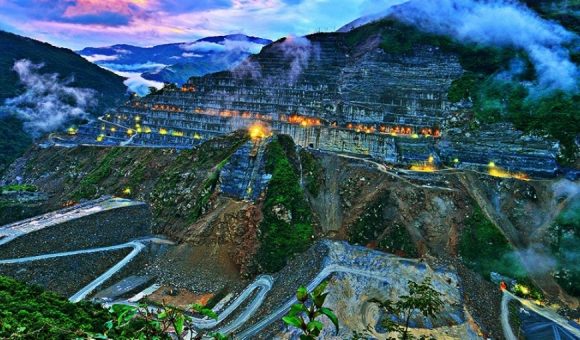

Three contractors principally involved in EPM’s US$5 billion, 2.4-gigawatt Hidroituango hydroelectric plant on August 14 unveiled a letter slamming EPM’s new COP$9.9 trillion (US$2.7 billion) “conciliation” claim tied to a diversion-tunnel collapse two years ago.

The contractors making-up the “Consorcio CCI Ituango” consortium — Camarga Correa Infra, Constructora Conconcreto and Coninsa Ramon H. – state in their letter to EPM general manager Alvaro Rendon that they are stunned by the new EPM compensation claim.

The conciliation demand, “ as well as the allegations of responsibility that you make against the Consortium, are unusual, to say the least, and contradict the conduct of EPM observed so far with respect to the contract, since no requirement or questioning has existed on the part of [CCC Ituango] regarding the way in which our obligations were fulfilled in relation to the construction of the GAD [diversion tunnel] and the contract in general.

“Contrary to the above, there have been clear expressions of appreciation for the work carried out by the CCC Ituango Consortium, work that, incidentally, prevented the destruction of the dam, avoiding what would have been the worst catastrophe in the history of the country,” according to the letter.

“If there were doubts on the part of EPM regarding our suitability or the belief that we incurred in a breach as serious as the one that we are being charged today, we would [not] have been entrusted with the execution of the project recovery activities.

“[T]he Consortium, respectful of the rule of law, has always been clear that any of the parties has the right to go to the respective judicial instances to resolve disputes that may exist between them.

“However, in this case, the truth is that between the parties there has not been any example of a controversy related to the breaches that are now being imputed to us, and as an example of this it should be noted that none of the enforcement or sanction mechanisms incorporated in the contract [have been invoked] — all the more reason to firmly question the fact that EPM abruptly adopts a position that goes against its previous actions and begins to foist upon us, not only in the limited scope of the judicial controversy but also in a public and ostentatious manner, an alleged breach that had never been dealt with directly during contract performance.

“We also want to warn about the serious and onerous consequences that are generated for the Consortium and the companies that comprise it, as a result of the initiation of this procedure given the direct impact on their image and their operation.

“On the other hand, we cannot accept that the alleged responsibility is entrusted to us, not based on the quality of the works entrusted to us, but for an alleged fault consisting of not warning EPM about alleged design errors.

“Therefore, in line with the foregoing, it should be noted that [engineering consultant] Skava’s report [on the diversion-tunnel collapse] that supports your request for preliminary conciliation flatly discards the hypotheses that could fall on our contractual obligations as builders related to issues such as the quality of the installed support, the concrete works, etcetera.

“In consideration of the foregoing, we call on EPM to reconsider the initial decision and withdraw the claims made against the CCC Ituango Consortium and against its members,” the letter concludes.

Fitch Ratings Warning

On a related front, Wall Street bond rater Fitch Ratings announced August 13 that it’s cutting EPM’s debt rating to ‘BBB-‘ just one step short of losing qualification, which potentially could hobble future debt floats and raise interest costs.

“The downgrading is due to a greater intervention by the owner of EPM, the city of Medellín [BBB- Negative Outlook], in the management of the company,” according to Fitch

“This represents a deterioration of the company’s corporate governance controls. Fitch believes that the actions recently taken by the company are contrary to the provisions of the Governance Agreement, signed on April 23, 2007, between the Mayor’s Office of Medellín and EPM’s management.

“Earlier this week, the eight independent members of EPM’s board of directors announced their resignations after the newly elected mayor of Medellín instructed the company to take certain actions without board approval.

“The resignations of eight of the nine board members follow an announcement in July 2020 that EPM’s social goal may be expanded beyond the provision of public services to include tourism services, new technologies, infrastructure, bridges and tunnels, among others.

“In addition, the company filed a COP$9.9 trillion (approximately US$2.7 billion) lawsuit this week against contractors, supervisors and contractor insurance companies for its beleaguered 2.4 gigawatt (GW) Hidroituango project without consulting with the board of directors.

“In June 2020, the company announced an additional delay [in Hidroituango start-up] due to the Coronavirus pandemic. Fitch’s expectation is that 300 megawatts (MW) of the project will be in operation by early 2022.

“Additional technical and infrastructure complications are possible, and could further delay the project’s commercial operation date.

“Additional unforeseen contingencies have been partially mitigated after the insurance company announced that the damages derived from the event would be covered by the insurance policy, although there is no clarity on when and what damages will be covered. The resolution of the Negative Observation could take more than six months due to these uncertainties,” Fitch added.