Medellin Fourth-Best among Colombian Cities for Doing Business: World Bank

A new report from the World Bank finds that Medellin is fourth-best among Colombia’s 32 departmental-capital cities in four key business categories: relative ease in starting a business, getting construction permits, registering properties and ease of paying taxes.

According to the Doing Business in Colombia report (see: http://www.doingbusiness.org/~/media/WBG/DoingBusiness/Documents/Subnational-Reports/DB17Sub-Colombia.pdf), Manizales took the top spot for ease of doing business, followed by Pereira, Bogota and Medellin.

“In general, the smaller the city, the greater the number of permits required, partly because regulatory reforms still haven’t reached all [Colombia] cities,” according to the report.

“Between 2013 and 2016, all cities except Ibagué and Santa Marta advanced toward meeting global best-practices standards, with Valledupar, Cúcuta, Leticia and Pereira making the most progress. Among those four cities, Valledupar was the city that made the most progress, realizing reforms in the three of the four categories.”

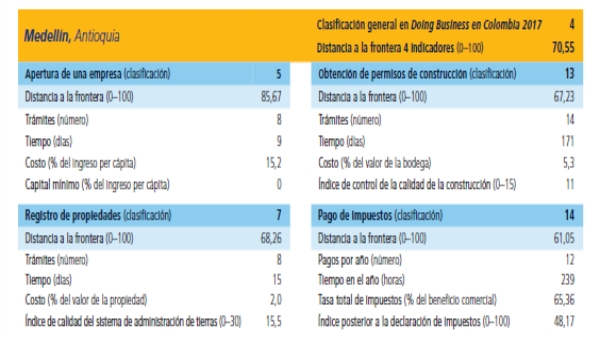

On a scale of 0 (worst) to 100 (best) for best-practices, Medellin scored 85.67 for opening a new business. However, Medellin came-in at only 68.26 for registering a property; 67.23 for getting construction permits; and 61.05 for ease of paying taxes (see chart, above).

Starting a Business

To analyze this factor, the report “registers all formalities required officially, or which are needed in practice, for an employer to be able to open and formally operate an industrial or commercial enterprise. In addition, the time and cost associated with completing the procedures and capital requirements are considered.”

Paying Taxes

To analyze this factor, the report “records the taxes and contributions that a medium-sized company must pay in its second year of activity. The number of payments, the method and the frequency of payment, the time associated with the preparation and filing of the tax returns and the total tax rate (proportion of taxes and contributions on the commercial benefit of the company) are considered. It also evaluates post-tax return processes such as tax refunds and audits.”

Property Registration

To analyze this factor, the report “records all the procedures required for a company to transfer title to a property to another purchasing company and [how] it can use the property to expand its business, [use it] as collateral for new loans or, if necessary, to sell it. The quality of the land management system is also evaluated.”

Obtaining Building Permits

For this factor, the report “records all the procedures, time and cost necessary for a company in the construction sector to complete the construction of a warehouse on the outskirts of the city.”