New National Tax Proposal Would Collect COP$25 Trillion Extra in 2023, COP$50 Trillion Extra by 2026

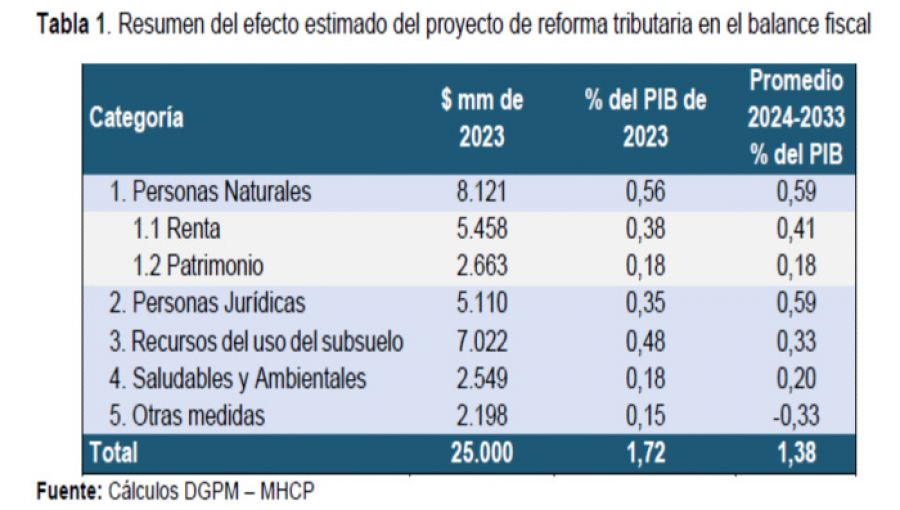

Colombia’s new Finance Minster Jose Antonio Campo on August 8 unveiled a 130-page tax proposal to the national Congress — aiming to boost tax collections by COP$25 trillion (US$5.8 billion) next year, then gradually increasing each of the following three years, hitting COP$50 trillion (US$11.58 billion) by 2026.

The proposed scheme generally follows promises made by Colombia’s newly sworn-in President Gustavo Petro to boost taxes on wealthier individuals and corporations, as well as producers of hydrocarbons and minerals (mainly oil, gas, coal and gold), new taxes on unhealthy sugary drinks and foods, on waste plastics, on profitable stock dividends, and reductions in many current tax exemptions.

If approved by Congress, the new scheme aims to slash income inequality and drastically reduce poverty levels at a rate nine-times that of prior tax-and-spending reforms over the past 14 years, according to Campo.

“The progress that the country has had in terms of health and education coverage, among others, must be maintained and accelerated to heal a deteriorated social fabric,” Campo states in the tax proposal.

“This tax reform project aims to advance fundamentally in two dimensions. First, by reducing the inequitable exemptions enjoyed by individuals with higher incomes and some companies, as well as closing avenues for tax evasion and avoidance,” he added.

A new “wealth tax” (patrimony) –considered by many nations including the U.S. as counter-productive — would hit people with liquid assets exceeding COP$3 billion (US$695,000), generating about COP$2.66 trillion (US$616 million ) in extra revenues next year. The principal residence would be excluded from the “patrimony” calculation, but second-homes and vacation-homes would be included.

Workers and business owners with incomes exceeding COP$10 million (US$2,315) monthly would be hit by higher income taxes, generating an extra COP$5.45 trillion (US$1.26 billion) in revenues in 2023.

Higher corporate income taxes would bring-in an extra COP$5.1 trillion (US$1.18 billion) next year, while higher taxes on hydrocarbons and minerals (including gold) would bring-in another COP$7 trillion (US$1.6 billion) extra next year.

New carbon taxes (the CO2 emitted by burning hydrocarbons) would net another COP$2.5 trillion (US$579 million), while taxes on sugary drinks and high-sugar-content processed foods would add another COP$2.2 trillion (US$510 million) in new revenue, according to the proposal.

While higher taxes on higher-wage workers and higher-income business people would dampen their spending, transfers of these higher taxes to poorer people would result an a “marginally positive” boost to gross domestic product (GDP) “in the coming years,” according to Campo.

“Distortions that could derive from the increase in effective tax burdens would be mitigated by the positive effects of the use of these resources in greater transfers to households of low income and an increase in public investment,” he claimed.

As for the net impact on poorer populations, simulation-studies indicate that “the gain in welfare of the first four years — defined as the sum of the utilities for each year, brought to present value — would be equivalent to increasing the current consumption of these poorer households by 7.5%.

“In contrast, this reform would decrease the welfare of higher-income households, on account of the higher tax burden they would face, although the effects would be minor compared to the gain in well-being of lower-income households.”

Meanwhile, “the incidence of monetary poverty would be reduced by 3.9 percentage-points, reflecting a fall of 10% in the total population living in poverty, while extreme poverty would decrease by 4 percentage points, which would represent a percentage decrease of 32.4% of the population living in extreme poverty in 2021,” according to the proposal.

Meanwhile, the tax-revenue transfers to poorer populations would cut the current “Gini” index of inequality by “nine times the average annual reduction of the last 14 years,” he said.

Colombia Former VP German Vargas Lleras Responds

In an opinion column published in Colombia’s biggest daily newspaper (El Tiempo), former Colombia Vice-President German Vargas Lleras sees serious issues with certain parts of the proposed tax reform.

“I am concerned that with the introduction of new taxes and the increase in some rates we will continue to deepen our loss of competitiveness, the outflow of capital will continue and it will not be possible to attract new investment, either local or foreign,” Vargas Lleras states.

“I had the opportunity to present to the appointed Finance Minister my concern about the return of non-technical taxes such as wealth. To this is added the increase in the tax on dividends and occasional profits by 100% and the dismantling of the discount in the ICA [industrial/commercial tax deductions] and the creation of new taxes such as those proposed for the mining-energy sectors, among others . . .

“How are we going to guarantee our energy security? With what does the [Petro government] think to replace the enormous income [from state oil company Ecopetrol] that just in this first half of 2022 represented US$16 billion [in government revenues] and is 54% of all our exports?”