Antioquia, Medellin: Statistical Review Shows Progress in Commerce, Infrastructure

Medellin – the capital of Antioquia department (state) – continues to grab more positive attention from national and international media.

In the August 21, 2015, edition of Dinero (a Colombian national business magazine), Medellin and Antioquia are featured in a special section analyzing economic growth and competitiveness.

Nearly 4 million of the approximately 6.4 million people in Antioquia live in the Medellin metropolitan area, which includes the adjacent cities of Bello, Envigado, Sabaneta, Itagui, Caldas, Barbosa, La Estrella, Girardota and Copacabana.

The report shows that about one-third of Colombia’s 60 “multilatina” companies (that is, large Colombian companies operating in various parts of Latin America) are based in Antioquia, including giants such as EPM, Nutresa, Sura, Argos, Orbis, Conconcreto and Bancolombia.

More than 13% of Colombia’s gross national product (PIB) is generated in Antioquia, with most of the activity centered in financial services, manufacturing, wholesale/retail commerce, hotels and restaurants, the study shows.

On the real estate front, according to latest Medellin Chamber of Commerce (CCM) statistics, 71,843 properties were bought or sold in the metro Medellin (Valle de Aburra) region last year, up 9.7% year-on-year, the report notes.

National GDP growth projections between now and 2018 indicate that Antioquia is growing at a rate faster than the rest of Colombia, at (for example) a 4.8% rate for in 2018 Antioquia alone, versus 4.4% for Colombia in total.

The market for Medellin’s municipal bond issuance also is relatively robust, with Medellin becoming the first city in Latin America to issue 30-year bonds – a sign of growing investor confidence, according to Mayor Anibal Gaviria.

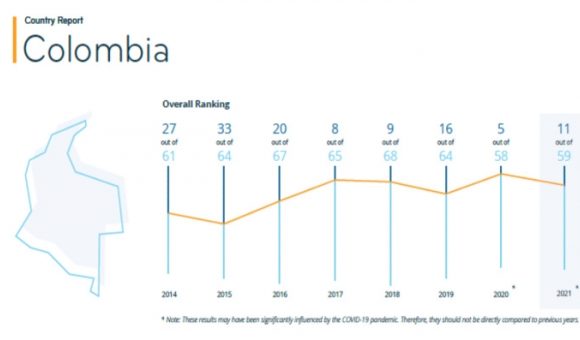

Similarly, according to departmental (state) government statistics, Antioquia has risen to second-place in national rankings of “competitiveness” among the 22 departments in Colombia.

Road infrastructure development – which has lagged for decades, as in most of Colombia – is starting to improve markedly, with big departmental projects soon connecting Medellin with major interstate highways via the “fourth generation” (4G) investment program.

One of those projects will open a direct highway link to ocean port infrastructure in Uraba, cutting hundreds of kilometers of distance, hours in traffic and shipping costs per-container for truck traffic to-and-from Medellin (as well as to/from Colombia’s main coffee region), compared to shipping to/from other Atlantic ports.

The nearly complete Panama Canal expansion is likely to give an extra boost to a new wave of privately funded port construction projects in Uraba, the first of which involves a US$350 million investment, according to the study.

Education Investments

On the labor-competitiveness front, Antioquia has pioneered the development of “education parks” (“parques educativas”) in 80 municipalities in the last four years. This is the signature project of Governor Sergio Fajardo, a former mathematics professor whose passion for education stands-out among Colombian politicians.

Similarly, Medellin is spending more than US$100 million on new construction and upgrades of “university cities” (“ciudadelas universitarias”) in less-advantaged areas, opening opportunities for 20,000 new students to earn degrees in the high-demand areas including technicians and technologists, as ProAntioquia president Rafael Aubad Lopez pointed out in a column for the Dinero special report.

On a related front, a new “technology district” in Medellin — covering 172 hectares and involving 50 companies from 10 countries — is now in development, led by the existing “Ruta N” technology business-incubator center (funded by city government and internet giants) adjacent to the University of Antioquia, Aubad pointed out.

What’s more, U-Antioquia recently has expanded its campuses geographically to include the strategic growth area of Uraba. This expansion will help entrepreneurs develop new projects (including export/import centers) tapping better-qualified, local labor in the future high-growth Uraba region, Aubad explained.