Antioquia’s 2017 Economic Outlook Superior to Colombia’s: CCM

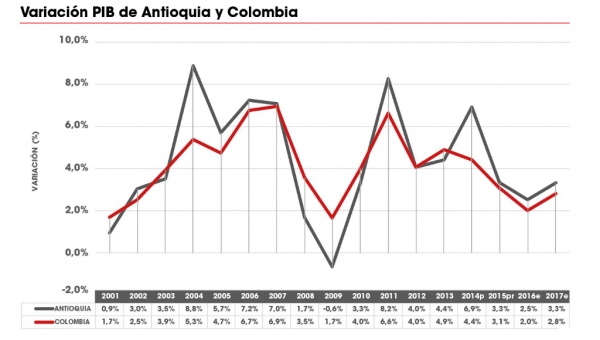

Medellin and the surrounding Antioquia department are likely to see 3.3% growth this year in gross domestic product (“PIB” in Spanish initials), according to the latest forecast by the Camara de Comercio de Medellin para Antioquia (CCM), the local chamber of commerce.

In a March 8 presentation here at a forum on Colombia’s macroeconomic outlook for 2017 — sponsored by economic analysts Fedesarrollo and Asociacion Nacional de Instituciones Financieras (ANIF) – CCM executive president Lina Velez de Nicholls showed how Antioquia continues to out-perform Colombia generally (see chart, above).

While Colombia’s PIB for 2016 came-in at a relatively mediocre 2.0%, Antioquia’s PIB last year was better, at 2.5%. Similarly, Colombia’s forecast PIB for 2017 is 2.7%, while Antioquia’s PIB forecast for 2017 is 3.3%, according to CCM.

Colombia’s nationwide economic slow-down in 2016 is mainly explained by falling domestic demand, a decline in government spending and a drop-off in demand from Colombia’s major trading partners, Velez explained.

On the positive side, however, private-sector investment by Antioquian companies within CCM’s jurisdiction rose 27.3% in 2016 versus 2015, she showed.

Factors favoring relatively robust economic growth in Antioquia in 2017 include continued private-sector investment, start-up in construction of major highway infrastructure projects, a rebound in commodity prices and the relative strength of the U.S. dollar versus the Colombian peso, which favors exports.

The “fourth-generation” (4G) highway infrastructure projects in Antioquia – most now underway — are expected to result in COP$12.5 trillion (US$4.2 billion) in new spending, including the “Pacifico 1,2,3” projects, the “Magdalena 2” project and the “Conexion Norte” project; the related “Mar 1” and “Mar 2” projects are still in pre-construction stage, while the “Vias del Nus” highway project has just started.

Meanwhile, the “Toyo Tunnel” project (linking “Mar 1” and “Mar 2”) — targeted for completion around 2025 — would require another COP$1.8 trillion (US$600 million), while the giant Hidroituango hydroelectric dam project due for start-up in 2019 represents another US$5.5 billion of investment in Antioquia, she pointed out.

However, factors that will tend to dampen greater economic growth in Antioquia during 2017 include relatively slow growth in the economies of major trading partners, relatively weak domestic demand because of the recent Colombia tax reform (which includes a higher consumption tax rate), and higher costs of imported materials, Velez cautioned.

On the other hand, Antioquia’s balance-of-trade showed improvement in 2016, with the U.S. dollar value of imports plummeting from US$7.34 billion in 2015 to US$5.8 billion in 2016, while Antioquia’s exports rose from $4.31 billion in 2015 to $4.33 billion in 2016.

In 2016, 2,427 companies in Antioquia were exporting products and services to foreign countries, although 20 of those companies accounted for 60% of the total value of exports, she showed.

Meanwhile, Antioquia continues to lead all of Colombia in national share of exports, at 20.7% share, with gold, bananas, plantains, coffee, motor vehicles, flowers and clothing accounting for the bulk of export revenues, according to CCM.

Antioquia also continues to breed more exporters, with 129 more companies joining the ranks last year, generating US$77 million more in export value.

Non-traditional export products dominated the growth of Antioquia’s exporting companies last year, including mining machinery, tropical lumber, non-alcoholic beverages, refrigeration systems, vehicle transmissions and prefabricated building materials.

However, exports as a total share of Antioquia’s PIB have been slipping in recent years, falling from 14.8% of PIB in 2005 to 11.1% in 2016. If gold export growth were excluded, then Antioquia’s export share of PIB fell even further last year, to just 8%, she showed.

As for growth in the number of commercial enterprises in Antioquia, about 25% of the total growth in the last three years has been in services with relatively high value-added, she showed.

Leading growth categories include administrative services, real-estate services, construction services, accounting and legal services, information-tech services, computer services, tourism services, civil engineering, architecture, vehicle repair, food services, road transport and health services, she showed.