Celsia 1Q 2024 Net Income Plummets 75.7% Year-on-Year

Medellin-based electric-power generator Celsia announced May 6 that its first quarter (1Q) 2024 net income plunged 75.7% year-on-year, to COP$29.7 billion (US$7.6 million), from COP$122 billion (US$31 million) in 1Q 2023.

Revenues for 1Q 2024 dipped 8.7% year-on-year, to COP$1.37 trillion (US$352 million), while earnings before interest, taxes, depreciation and amortization (EBITDA) fell 36.6%, to COP$326 billion (US$83.8 million), according to the company.

Celsia blamed the results largely on the El Niño drought that started in Colombia late last year, cutting water flows to and through its hydroelectric dams.

However, the latest version of El Niño was less damaging to Celsia — and to Colombia generally — during this year, compared to the prior 2015-2016 drought.

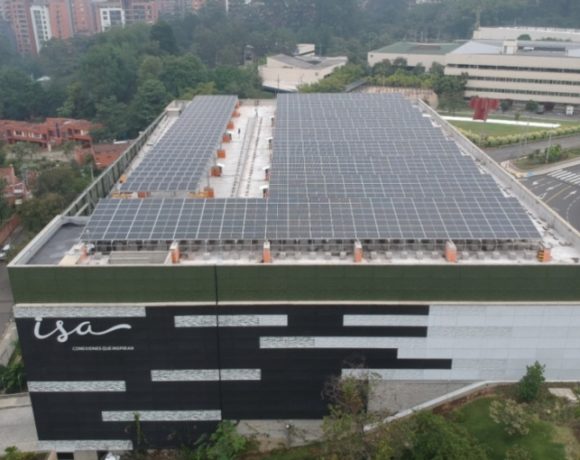

Because of the negative experience impacting power generation from that prior drought, Celsia “rethought the competitive strategy of the generation business, balancing our predominantly hydro-based matrix with greater non-conventional energy from the sun and the reconfiguration of our thermal-power portfolio” – which now includes the 200-megawatt (MW) “El Tesorito” natural-gas-fired plant.

“At the end of the first quarter [2024], the aggregate volume of Celsia’s [hydroelectric dam] reservoirs was 33% and we are starting the month of May with a volume of 44%,” Celsia CEO Ricardo Sierra explained.

“Regarding thermal generation, we had an important contribution [to the Colombian national power grid], although we expected a greater contribution, but market conditions did not allow it,” he added.

In total, 86% of Celsia’s income during 1Q 2024 came from electric power generation, transmission, distribution and marketing, while its investment platforms accounted for the remaining 14%, according to the company.

“Cost of sales for the latest quarter reached COP$1.06 trillion [US$272 million], an increase of 6.4% mainly due to the increase in generation costs due to the El Niño phenomenon,” according to the company.

“Net financial expenses, including exchange differences, reached COP$163.8 billion [US$42 million], a decrease of 29.9%. Improvements were made in credit conditions which, added to the behavior of the indexes, allowed an average reduction of 150 basis points in the cost of debt compared to the fourth quarter of 2023.

“Income taxes were $20.8 billion [US$5.3 million] in the latest quarter and decreased 67.6% due to lower profit before taxes,” the company added.

Consolidated debt closed at COP$5.27 trillion [US$1.35 billion] with a leverage indicator of 2.82-times net-debt-to-EBITDA, according to Celsia.

“In the coming months we hope that with the return of a more normalized climate period we will return to an EBITDA margin between 32% and 35% and we will be able to finish reaping the benefits of the negotiations we have made to improve the financial cost of the debt,” Sierra added.

Besides investing more in of solar-photovoltaic farms — along with its hydroelectric plants and its natural-gas-fired plant – Celsia also is investing in water conservation via the “ReverdeC” forestry project “for the snow-capped mountains of Tolima and the Combeima River basin,” according to the company.

“This project is also protecting other hydrographic basins of great importance in Tolima, where more than 2.4 million native trees have been planted. In total, 15.8 million trees have been planted in the country to date,” Celsia explained.