EPM 1Q 2024 Net Income Up 6% Year-on-Year

Medellin-based multinational electric-power, water, wastewater and trash-disposal giant EPM announced May 7 a 6% year-on-year hike in net income, hitting COP$1.7 trillion (US$435 million)

Earnings before interest, taxes, depreciation and amortization (EBITDA) rose 17% year-on-year, to COP$3.4 trillion (US$871 million), while gross revenues rose 12% year-on-year, to COP$10.1 trillion (US$2.58 billion), according to EPM, 100% owned by the city of Medellin.

So far this year, EPM has invested COP$1.1 trillion (US$282 million) in infrastructure for its electric power, water and natural-gas distribution services, according to the company.

Of the EPM Group’s total EBITDA so far this year (COP$3.4 trillion/(US$871 million), “the energy generation and marketing segment contributed 43%, at COP$1.5 trillion [US$384 million],” according to the company.

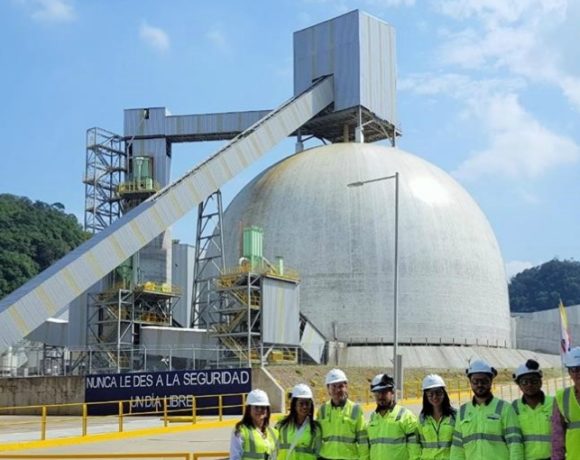

“This result highlights the availability of energy and the generation of the four units of the Hidroituango hydroelectric plant, which contributed 29% of the energy generation of the EPM Group,” according to EPM.

EPM’s power-distribution segment contributed 39% of total EBITDA, at COP$1.3 trillion (US$333 million), “thanks to the growth in energy demand,” according to the company.

“Despite the effects of the El Niño [drought] phenomenon, the EPM Group has continued to supply energy uninterruptedly,” the company added.

Meanwhile, EPM’s water and solid-waste management units together contributed 14% of the Group’s EBITDA; these units enjoyed 1Q 2024 year-on-year growth of 47%, according to the company.

“During the first quarter of 2024, the EPM Group generated added value of COP$5 trillion [US$1.28 billion], 10% more compared to 2023, which has made it possible to reinvest in projects to maintain the operational capacity of the businesses,” according to EPM.

“In addition, [profit] transfers from the electricity sector allowed resources to be allocated to more than 194 Colombian municipalities, natural parks and regional autonomous corporations,” according to the company.

Meanwhile, total debt-to-EBITDA ratio for 1Q 2024 closed at 2.68, an improvement from the 2.80 ratio for 1Q 2023.

This improvement “reflects a greater growth in EBITDA in the last 12 months compared to the growth in long-term financial debt, indicating adequate compliance with the covenants that have been agreed upon in different credit operations and a level in accordance with EPM’s objective risk rating,” according to the company.