Colombia Making ‘Remarkably Smooth Adjustment’ to Economic Shocks: IMF

The International Monetary Fund (IMF) announced in a report issued May 31 that Colombia’s economy is starting to rebound – and it’s performing much better than its neighbors following the oil-price collapse nearly three years ago.

As a result, real gross domestic product (GDP) growth would rebound to 2.3% this year, up from 2.0% last year, according to the report.

Inflation as measured by consumer price index (CPI) is expected to fall to 4.5% this year, down from 7.5% last year, while current-account deficit is seen dropping to 3.8% of GDP, down from 4.4% last year, according to the report.

“In 2016, Colombia continued a remarkably smooth adjustment to a combination of large external and domestic shocks, with economic growth outpacing regional peers and achieving further improvements in poverty and inequality,” according to the report.

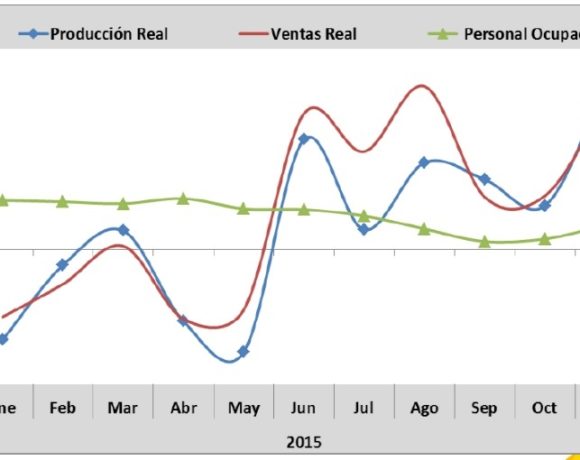

While GDP growth slowed in 2016 versus 2015 due to falling oil revenues, weak demand from neighbor countries and higher inflation, “Colombia faces a favorable outlook underpinned by the peace agreement and the structural tax reform together with the authorities’ infrastructure agenda,” according to the report.

“Economic activity will rebound slightly this year as investment will strengthen boosted by reduced corporate taxation and confidence stemming from the peace agreement.

“Non-traditional exports are gaining steam in part due to ongoing efforts to reduce trade barriers and this will contribute to bring the current account deficit to its equilibrium level.

“Medium-term growth will be driven by economic diversification away from oil, which will benefit from the infrastructure agenda and the peace agreement that will improve ompetitiveness and regional development.

“Risks to this outlook are to the downside with the main near-term risk stemming from the still large (but moderating) external financing needs. Domestically, while the banking system appears sound and broadly resilient to shocks, some pockets of corporate vulnerability have emerged.

“On the upside, a faster-than-expected implementation of the peace agreement could strengthen medium-term growth even more.

“Going forward, inclusive growth will depend more on diversification supported by structural reforms including on improving infrastructure, streamlining regulation, easing trade barriers and strengthening the efficiency of public expenditure. The tax reform will boost medium-term inclusive growth by allowing a strengthening in public investment and social spending,” IMF concluded.

IMF’s near-term outlook is for a “gradual growth pickup,” according to the multilateral agency.

IMF “projects growth to increase to 2.3% in 2017 as the economy gradually diversifies away from commodities. Lower inflation will partly offset the drag on private consumption from the VAT [value-added tax] increase while investment is expected to pick up in the second half of the year.

“Credit growth will be subdued as lending standards tighten in response to somewhat weaker corporate financial strength and due to softening consumers’ credit demand. Medium-term growth of about 3.5% will be underpinned by non-commodity exports, infrastructure spending, and improved confidence stemming from the peace agreement.

“The current account deficit is projected to narrow further in 2017 and gradually converge to its medium-term equilibrium. Additional import compression due to sluggish domestic demand, improved tourism receipts, and growing non-traditional exports will reduce the deficit to 3.8 % of GDP in 2017,” the report concludes.