Fitch: Colombia’s 2021 Post-Crisis Recovery Hobbled by Weak Tax Revenues; Bancolombia Analyzes Current Situation

Wall Street bond rater Fitch Ratings on May 14 unveiled a report finding that Colombia will struggle to fill a fiscal hole next year because of economic damage and revenue losses in the Coronavirus crisis — along with continuing pressures to boost social spending.

In the current crisis, the Colombian government has been spending billions of dollars in subsidies for hospitals and poorer patients, for health-care workers, for millions of private-sector workers, for indigent families — and simultaneously helping to restore liquidity for micro-, small, medium and larger businesses during the Covid-19 quarantine shutdowns.

“Further reductions to our growth forecasts for Colombia (BBB-/Negative rating) due to the Coronavirus pandemic will mean faster increases in budget deficits and public debt this year,” the Fitch report warns.

“For Colombia, we forecast a [2020 GDP] contraction of 4.5%, compared with negative 2% previously. [These] revisions reflect the extension of domestic lockdown measures with a large impact on consumption and investment as well as the Coronavirus pandemic’s broader effects on lower commodity prices, higher funding costs and capital outflows . . .

“In Colombia, the likely fall in oil production will also hit growth [while] deep recession magnifies fiscal deterioration. We forecast Colombia’s central government deficit to rise to 7% compared with our previous forecast of 5.5%.

“Colombia’s debt-to-GDP ratio will rise to 55%, up more than and 10 percentage points from 2019.

“The Colombian government recently announced further support measures including wage subsidies for some companies and deferring income tax payments until December, as well as increasing fiscal stimulus spending to 2.4% of GDP, from 1.4%,” Fitch noted.

In addition, Colombia’s central bank has “lowered policy rates and provided liquidity to credit markets through bond-buying programs among other measures. Lack of fiscal consolidation that allows government debt to continue rising is a negative rating sensitivity for sovereign [debt],” the rating agency added.

“Colombia’s finance minister has mentioned possible tax reform next year . . .However, continuing deterioration in near-term economic and fiscal prospects increases the importance of formulating credible medium-term plans, including fiscal reforms on the revenue or expenditure sides, to sustainably restore growth and stabilize debt.

“Failure to address the risk of lasting economic damage stemming from the current crisis would intensify pressure on the rating.

“Weaker growth prospects would adversely affect debt dynamics and could exacerbate social tensions, in Fitch’s view.

“Colombia faces challenges raising tax revenues over the medium term, especially given the expected loss of oil-related revenues worth over 1% of GDP in 2021 and reduced tax revenues due to the 2019 Economic Growth Law.”

What’s more, Colombia faces “social and political pressures to increase pension, healthcare and education spending, highlighted by protests between October and November 2019.

“Elections in May 2022 in Colombia may narrow the window of opportunity for reforms,” the company added.

Bancolombia Analysis

On a parallel front, Medellin-based banking giant Bancolombia issued a new report analyzing the impact of the gradual reopening of the Colombian economy during the Covid-19 crisis.

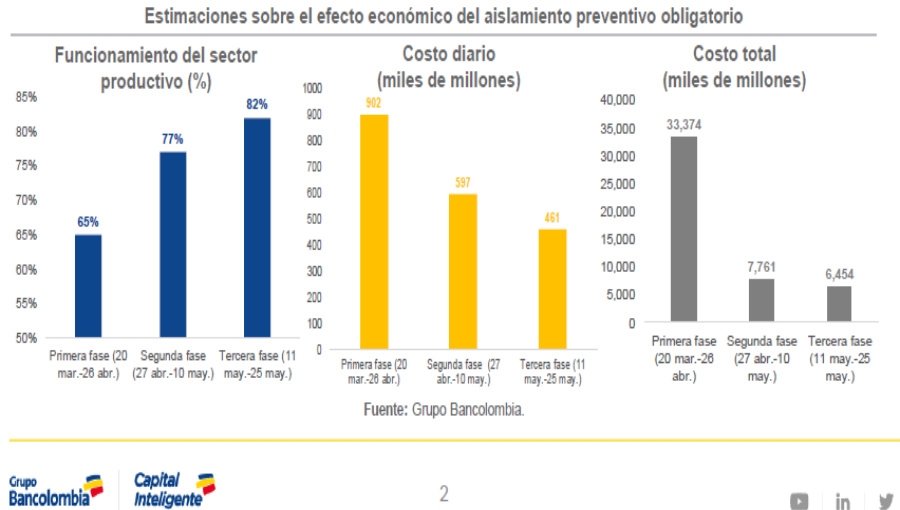

“In the first phase of compulsory isolation, between March 20 and April 26, the Colombian productive apparatus had an effective operating percentage of 65%,” the report found.

“This [productive-sector operational] figure increased to 77% in the second phase, from April 27 to May 10.

“In the first phase and second phase of quarantine, the economy would have stopped producing around COP$900 billion [US$230 million] and COP$600 billion [US$153 million] per day.

“Since May 11, the operating percentage would have risen to 82% and the new daily cost would drop to COP$460 billion [US$117 million].

“The gradual reopening of some productive sectors can reduce the economic cost of quarantine by about COP$10 trillion [US$2.55 billion],” Bancolombia found.

“The aforementioned [analysis] led to the estimated annual variation in productive activity [GDP growth] going from 2.7% in the quarter ending in March to almost -10% towards mid-April, when it bottomed out.

“In the second half of April and the first days of May, the decrease has moderated to -7.6%. As a result, we calculate that the total cost of mandatory quarantine [through May 11] can be COP$48 trillion [US$12.2 billion].

“Therefore, it is shown that the safe operation of more productive sectors can mitigate the significant economic effect that the Covid-19 [quarantine] brings,” Bancolombia concluded.