EPM 3Q 2025 Net Income Drops 24% Year-on-Year

Medellin-based multinational electric-power generator-distributor and water/telecom/cable-TV/internet giant EPM on November 4 reported a 24% year-on-year drop in net income for third quarter (3Q) 2025, at COP$2.8 trillion (US$730 million).

Revenues also dipped 5% during 3Q 2025, to COP$29 trillion (US$7.56 billion), while earnings before interest, taxes, depreciation and amortization (EBITDA) fell 9%, to COP$8.5 trillion (US$2.2 billion).

EPM also transferred COP$2.25 trillion (US$586 million) to its 100% owner – the city of Medellin — “earmarked for strengthening social investment in the city,” according to the company.

“Net income distribution by segment was 50% in energy distribution, 43% in generation, 15% in water supply, sewerage, and wastewater management, 5% in [power] transmission, and 2% in natural gas,” according to the company.

“The debt/EBITDA ratio remained below the contractual limit of 3.5, with debt service coverage of 2.98 for the Group and 3.47 for EPM parent company.

“Although operations remain profitable, the decrease in margins and net income indicates increasing pressure on profitability and cash flow.

“The EPM Group operates in a complex and highly competitive regulatory environment, where service provision includes the need to guarantee supply reliability, efficient infrastructure, and rising costs, especially in remote areas.

“Added to this are the lack of timely subsidy payments and the risk of losing [natural] gas self-sufficiency, affected since the previous year by the decline in the wholesale market, supply restrictions, lower consumption, and reduced tariffs.

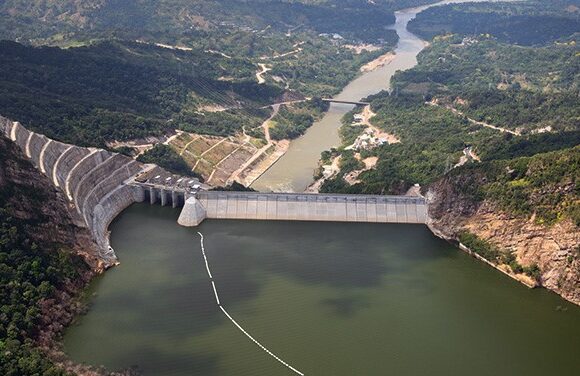

“In this scenario, marked by high social investment and strategic projects such as [the 2.4-gigawatt hydroelectric project] Hidroituango, cash management becomes a determining factor to ensure sustainability and avoid risks in fulfilling commitments.

“In this context, the austerity measures adopted are not merely a response to a specific situation, but rather part of a strategic vision that seeks to strengthen the organization’s financial resilience in the face of potential adverse conditions in the economic environment,” the company added.

So far this year, EPM Group has allocated COP$3.2 trillion (US$834 million) to infrastructure projects “aimed at guaranteeing the quality, continuity, and coverage of public services for millions of people,” according to the company.

That total includes COP$711 billion [US$185 million] for Hidroituango, another COP$189 billion (US$49 million) for “power plant modernization,” plus COP$1.6 trillion (US$417 million) for energy distribution and marketing and COP$662 billion (US$172 million) for drinking-water supply, sewage, and solid waste management.

“These projects not only improve service delivery for current users but also prepare these regions for future generations, generating employment and well-being in Colombia, Chile, El Salvador, Guatemala, Mexico, and Panama,” the company added.