Expat Taxes for USA 2016 Tax Year: Avoid Confusion

Editor’s Note: The following column was written by IRS enrolled agent and chartered financial analyst (CFA) John Ohe of Hola Expat Tax Services. Medellin Herald does not specifically endorse the author’s opinion; this column is for general information only and should not be construed as personal tax advice.

There is a lot of confusion among US expats (both new and long-standing) on the topic of US expat taxes. Often times, the information available online and elsewhere is hard-to-understand, and/or addresses a very specific topic. The purpose of this article is to review key facts on US expat taxes, highlighting the most important factors before filing a US tax return as an expatriate living abroad.

The United States has a highly stringent policy when it comes to the taxation of its citizens and permanent residents (i.e., those with a green card). The US government taxes all of its citizens based on worldwide income, which means it does not matter where the money is earned. Many Americans, especially dual citizens, are surprised when they learn this fact.

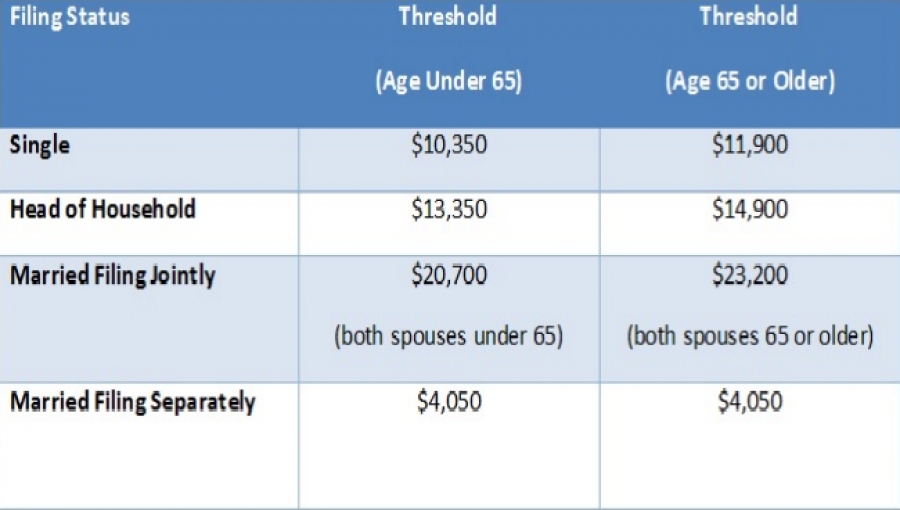

The filing requirement kicks in at specific thresholds (based on filing status). The table (see graphic, above) identifies the thresholds for 2016.

2016 US tax filing requirement

For self-employed individuals, the above thresholds do not apply. They are required to file a US tax return when net earnings reach a meager $400. Furthermore, individuals with businesses established outside the US have other informational filing requirements (discussed below).

Foreign Income Exclusion

US citizens and permanent residents may be able to exclude up to $100,800 in foreign earned income provided they meet certain qualifications. Foreign earned income is based on where the work is conducted, and not determined by location of employer, nor where the payment for services take place.

For married couples, the foreign earned income exclusion can be utilized separately by each spouse. Given the high exclusion amount, most US expats end up not owing any taxes, although they are required to file a tax return. For the first year living abroad, the application of the foreign earned income exclusion requires a certain pro-rated calculation (based on days outside the US).

In countries with a higher income tax rate than in the US, it is often preferable to utilize the foreign tax credit, rather than the foreign earned income exclusion to eliminate US tax liability. The foreign tax credit addresses the issue of double taxation. Amounts paid to a foreign government directly offsets any US tax amounts. An attractive feature of the foreign tax credit is that unused foreign tax credits can be carried forward up to 10 years.

The foreign tax credit is income category specific, which means that foreign taxes paid on earned income will only offset the US tax liability on earned income. Foreign taxes paid on passive income (e.g., investment income, bank interest, rental income) can only be applied toward the US tax liability on passive income.

US Expats with Children (Child Tax Credit)

Many more US expats would file a tax return, if they knew about the Child Tax Credit. Basically, it is a gift from the IRS to those with moderate income. Families that qualify can receive a tax refund, without having paid any taxes. The Child Tax Credit is worth up to $1,000 per child under the age of 17. To claim the credit, one needs to have a social security number for each child.

Effective 2015, the rules changed such that when the foreign earned income exclusion is exercised on the tax return, the Child Tax Credit becomes inapplicable. A potential work-around is to file separate returns, with the lower-earning parent reporting the children on his/her tax return. Although this approach is somewhat more complicated, it preserves the child tax credit in many instances.

Foreign Financial Account

US persons (including entities) with an interest or signature authority over foreign financial accounts that have an aggregate balance exceeding $10,000 are required to file the FBAR (FinCen 114). Foreign financial accounts include: bank accounts, brokerage accounts, mutual funds, annuities, life insurance policies with cash value, and indirect interests in financial accounts through a foreign entity (if >50% ownership).

The FBAR is separate requirement from your tax return. The $10,000 aggregate balance threshold is at any point during the year, and not the year-end balance. Therefore, it is advisable to maintain records of your monthly account balances. Account balances need to be converted to U.S. dollars, using the F/X rate as of the last day of the year.

Failure to file the FBAR carries hefty penalties. Important to note, with the implementation of FATCA (Foreign Account Tax Compliance Act), foreign financial institutions are providing the IRS with the details of foreign financial accounts held by US persons. As a result, non-reporting is an increasingly risky proposition.

Foreign Rental Property

Rental income from foreign properties should be reported on a US tax return. Aside from the worldwide income requirement, there is a practical reason for reporting. When a US expat sells a foreign property, he or she will typically deposit the proceeds in a foreign bank, or have the funds transferred to a US bank.

If the proceeds are deposited in a foreign bank, the IRS will receive account-specific information (per the above discussion on FBAR). If the funds are transferred to the US, the bank may inquire about the nature of the money being deposited. With either scenario, there is risk of a “red flag” being generated within the IRS.

US Expats with Foreign Business

Many US expats start a business while living abroad. The IRS has a high level of interest in foreign businesses owned by US persons. That is because some Americans hide income and assets through foreign entities (i.e., tax evasion). There are strict reporting requirements. Severe penalties can apply if certain informational returns are not filed appropriately.

Given the complexity of the various reporting requirements, we will not go into any specifics in this article. However, some of the relevant IRS forms include: 5471 (foreign corporation), 8865 (foreign partnership), 8858 (foreign disregarded entity).

US Expats and Retirement Saving

Saving for retirement is an important consideration, regardless of where one lives. In the US, many Americans utilize tax-efficient vehicles to save for retirement (e.g., 401k plans, IRAs). Similarly, US expats should utilize tax-efficient vehicles to save for their retirement. Some tax planning is likely to be required to allow for contributions.

For example, contributions to an IRA requires taxable income. For US expats utilizing the foreign earned income exclusion, they would need to calibrate the exclusion amount to create taxable income, thus allowing for an IRA contribution.

Social Security is a life-long pension that US expats should include in their plans for retirement. For low to modest income earners, what one receives during retirement can be far greater than the amount contributed.

However, many US expats who moved abroad prior to qualifying for Social Security benefits find themselves in a difficult position. Fortunately, there are ways to contribute to Social Security while living abroad. Generally speaking, the easiest path is start a small business, and report the income on a tax return.

To qualify for Social Security, one needs to earn 40 credits. Find out whether you have qualified by visiting SSA.gov and creating an account. You will need to provide a US mailing address (usually the last one on record with the federal government).

US Expat Tax Filing Deadlines (2017)

US expats are given an automatic 2-month extension to file their tax returns. Therefore, the filing deadline is June 15, 2017. However, tax payments (if applicable) are due on April 17, which is the standard filing deadline. If one owes taxes, and files after April 17, interest charges will begin to accrue. Also, the failure-to-file penalty will kick in after the filing deadline. To avoid the failure-to-file penalty, many US expats request an additional extension (October 16, 2017).

Effective 2016, the FBAR filing deadline coincides with the tax return (including extensions).

For more information on a wide range of tax-related topics, visit us at: www.holaexpat.com.