Colombia’s Tax Reform Proposal: Better for Business, Investment

Colombia’s Home Minister (Ministro de Hacienda) Mauricio Cardenas on October 19 finally unveiled a long-awaited, 182-pages-long tax reform proposal that would bring business and investment taxes more in-line with international standards — and thus help Colombia attract more investment while creating more “formal” employment as well as more personal income taxes.

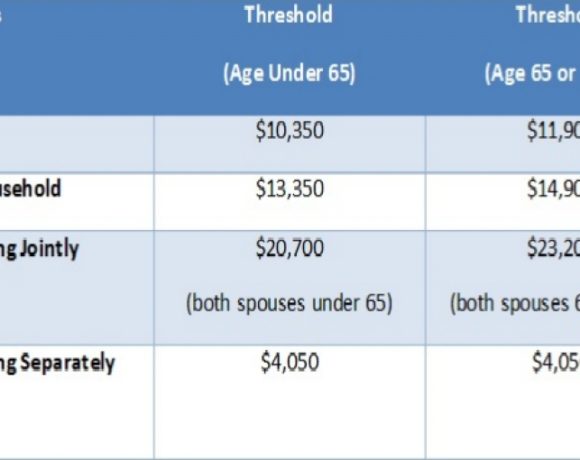

Colombian corporations have total tax burdens (69.7%) that are far above those of regional competitors as well as competitors in the USA (43.9%), Minister Cardenas showed in his proposal (see chart above).

According to the proposal, companies with profits exceeding COP$800 million (US$272,500) would see their taxes on profits cut to 36%, from 42% currently, while companies with less-than COP$800 million in profits would see their tax on profits cut to 32%, from 34% currently.

What’s more, the current “wealth tax” hitting certain relatively well-off companies and persons would be eliminated, further incentivizing more investment in Colombia, he explained.

Companies operating in Colombia (both domestic and foreign) that are already shouldering relatively large contributions to national employee health and pension plans also would be able to trim these contributions to a certain maximum amount, in order to stimulate more hiring of “formal” employees.

The new proposal also would enable hefty deductions for investments in non-conventional energy projects; 20% deductions for charitable donations, reforestation projects and environmental projects; and hefty deductions for investment in science, technology and innovation projects.

New and remodeled hotels built before December 31, 2017, also would get 30-year tax breaks (until 2047) under the proposal, which aims to support Colombia’s booming tourist growth.

Businesses and services that would be exempt from taxation until 2018 include water-borne transport; ecotourism; software development; special economic export zones and certain rental-housing properties owned by investor groups.

In areas of Colombia that have suffered from narco-terrorist violence, newly founded “micro” and “small” enterprises wouldn’t pay any taxes on profits from 2017 to 2021, while newly founded medium-and-large enterprises in these areas would pay only half of the normal tax rate during the same period.

However, mining and hydrocarbons companies wouldn’t receive such tax breaks even when operating in these hard-hit areas, according to the proposal.

Individual Income Taxes

As for new income tax rates on natural persons (individuals) starting in 2018, Colombia would exempt all those making less-than COP$3.2 million (US$1,090) per month – that is, 93% of Colombia’s population, according to the Ministry.

For those making COP$3.2 million, the income tax rate would be 1%. The tax would rise to 2% for those making COP$4 million (US$1,365) per month; 4% on COP$5 million (US$1,706) per month; 5% on COP$6 million (US$2,047) per month; 6% on COP$7 million (US$2,388) per month; 7% on COP$8 million (US$2,730) per month; and 8% on COP$9 million (US$3,070) per month.

The tax would rise to 9% on those earning COP$10 million (US$3,412) per month; 10% on COP$11 million (US$3,753) or COP$12 million (US$4,094) per month; 11% on COP$13 million (US$4,435) or COP$14 million (US$4,775) per month; 12% on COP$15 million (US$5,116) or COP$16 million (US$5,456) per month; 13% on COP$17 million (US$5,797) or COP$18 million (US$6,139 ) per month; and 14% on COP$19 million (US$6,480) or more per month.

Current tax breaks will continue for the “Ahorro para el Fomento de la Construcción” (AFC) savings accounts for housing purchases, along with tax breaks for voluntary pension-plan accounts, employment severance payments, maternity leave and certain benefits for judges, prosecutors and military, according to the proposal.

Micro-Business ‘Unified’ Taxes

A new, simplified “monotributo” (single-unified tax) scheme would become a new option for thousands of micro-scale businesses in Colombia, many of which already pay some income taxes, according to the proposal.

This new scheme also would enable such micro-business to qualify for Colombia’s workmen’s compensation system (“ARL” in Spanish intials) for accidents, as well access to enrollment in the “Beneficios Economicos Periodicos” (BEPs) program for old-age pensions.

Under this new scheme, a micro or small business making COP$83 million (US$28,250) to COP$104 million (US$35,395) per year would pay a “mono-tribute” (single tax) of just COP$960,000 (US$326) per year, while simultaneously enabling access to the ARL and BEP benefit systems, according to the Ministry.

Micro enterprises making between COP$41.5 million (US$14,123) to COP$62.4 million (US$21,236) per year would pay a tax of COP$120,000 (US$41) each quarter; while those making from COP$62.48 million (US$21,260) to COP$83.3 million (US$28,343) would pay a tax of COP$180,000 (US$61) each quarter. Those earning from COP$83.3 million (US$28,343) to COP$104 million (US$35,394) would pay a tax of COP$240,000 (US$81) each quarter, under the proposal.

While these tax payments would be relatively small, the “montributo” scheme would at last bring many more Colombian “micro” businesses into the “formal” sector, according to the Ministry.