IMF: Global GDP to Contract in 2020, Rebound in 2021; Colombia Doing Better than Most

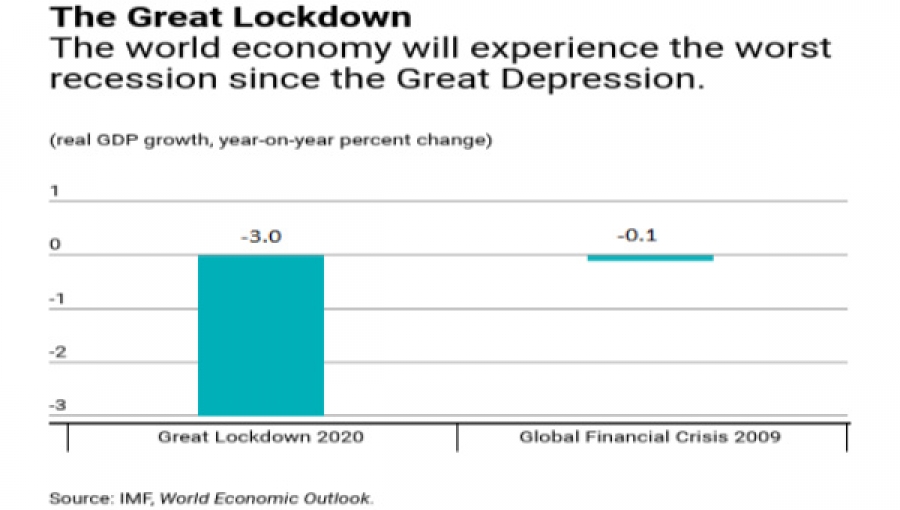

The International Monetary Fund (IMF) on April 14 issued an updated forecast concluding that the Coronavirus crisis likely will slash 2020 global gross domestic product (“PIB” in Spanish initials) to a net-negative 3% — compared to 2.9% net-positive PIB growth in 2019.

Colombia likewise probably will suffer a net-negative 2.4% PIB in 2020, IMF’s report concludes.

But Colombia’s PIB contraction in 2020 looks far better than Latin America as a whole, which is expected to suffer a net-negative 5.2% PIB in 2020 — more-than twice-as-bad as Colombia’s situation, according to IMF.

Fortunately — assuming the Coronavirus crisis eventually dissipates – Colombia is likely to see a PIB-growth rebound in 2021 to a net-positive 3.7%, better than the 3.4% PIB growth seen for Latin America as a whole in 2021, according to IMF’s latest World Economic Growth projections.

“The Covid-19 pandemic is inflicting high and rising human costs worldwide, and the necessary protection measures are severely impacting economic activity,” according to IMF’s report.

“As a result of the pandemic, the global economy is projected to contract sharply by –3% in 2020, much worse than during the 2008-2009 financial crisis.

“In a baseline scenario — which assumes that the pandemic fades in the second half of 2020 and containment efforts can be gradually unwound — the global economy is projected to grow by 5.8% percent in 2021 as economic activity normalizes, helped by policy support.

“The risks for even more severe outcomes, however, are substantial. Effective policies are essential to forestall the possibility of worse outcomes, and the necessary measures to reduce contagion and protect lives are an important investment in long-term human and economic health.

“Because the economic fallout is acute in specific sectors, policymakers will need to implement substantial targeted fiscal, monetary, and financial market measures to support affected households and businesses domestically,” the IMF report concludes.

In a related report on global government policy responses to the crisis, IMF noted that “to date, central banks have announced plans to expand their provision of liquidity — including through loans and asset purchases — by at least US$6 trillion and have indicated a readiness to do more if conditions warrant.

“As a result of these actions aimed at containing the fallout from the pandemic, investor sentiment has stabilized in recent weeks. Strains in some markets have abated somewhat and risk asset prices have recovered a portion of their earlier declines. Sentiment continues to be fragile, however, and global financial conditions remain much tighter compared to the beginning of the year,” IMF warned.