Medellin, Antioquia Likely to See 3% GDP Growth in 2018: Chamber of Commerce

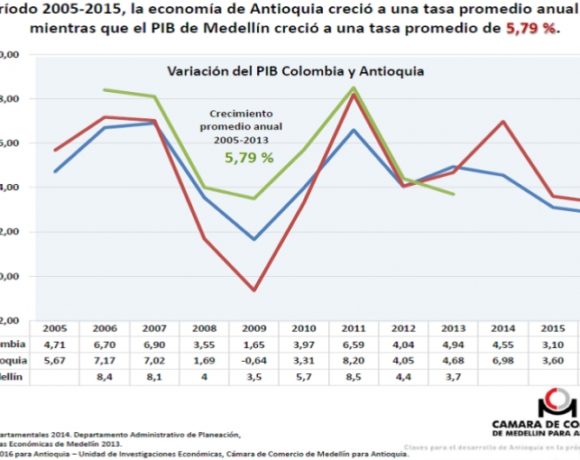

The Chamber of Commerce of Medellin for Antioquia (CCMA) projects that Antioquia likely will see 3% growth in gross domestic product (“PIB” in Spanish initials) this year, up from 2.2% last year.

As noted in a March 15 bulletin from Confecamaras (the Colombian national association of chambers of commerce), Antioquia out-performed Colombia nationally last year, with 2.2% GDP growth locally versus just 1.8% nationally.

As for 2018, the Medellin chamber foresees 3% GDP local growth thanks to “lower interest rates, growth in industrial exports, better prospects for private investment and public spending,” the report noted.

In a related report posted to the Medellin chamber’s web-site (http://www.camaramedellin.com.co/site/Noticias/Desempeno-economico-de-Antioquia-y-perspectivas.aspx), CCMA noted that exports from Antioquia grew 3.3% last year – to US$4.478 billion. Gold, fruits (especially bananas), coffee, vehicles, flowers, clothing, plastics, machinery and essential oils were the leading export products.

Meanwhile, copper exports jumped by 126% year-on-year –mainly to Spain and Singapore – while textile exports grew 15%, mainly to Brazil, Ecuador and Mexico, according to CCMA.

While local government spending grew 4% here, up from 2.4% in 2016, “industry, commerce and construction showed lower growth because of slow growth in internal demand and the negative impact of the [2017] tax reform, affecting personal consumption,” the CCMA report notes.

Investment in private corporations last year grew 18.6% year-on-year, by COP$1.01 trillion (US$353 million), with management consulting, road transport, metal-mining, machinery installation and maintenance, lumber and fisheries, health-care, and telecommunications taking leadership among all investment categories, according to the report.

However, industrial production in metro Medellin declined by 4.6% year-on-year through September 2017, while local industrial energy demand fell 7.9%, the report noted. The biggest declines were in textiles, iron works, foundries and clothing manufacture, according to CCMA.

While 139 companies relocated to Medellin from elsewhere in Colombia (mainly Bogota and Barranquilla) during 2017, 133 other companies decided to leave Medellin, mainly going to Bogota, Cali, Barranquilla and Cartagena, the report found.

Factors attracting companies to Medellin include relatively favorable access to clients and suppliers, the existence of local companies providing required services and information, relatively good urban and social infrastructure, qualified labor, relatively efficient public administration, and the existence of research centers (such as universities), the CCMA report found.

However, negative factors cited by companies included relative costs of public services, relatively high land costs, lack of local natural-resources, labor costs, lack of fiscal incentives and some concerns about security.