Medellin & Antioquia Sales Crashing; Business Liquidity Vanishing; 130,000 Jobs Lost Here in Coronavirus Crisis

The Medellin Chamber of Commerce for Antioquia (CCMA) just revealed a new study indicating that the Coronavirus quarantine costs the local economy here at least COP$170 billion (US$42 million) every day — and 95% of businesses have seen sales drop anywhere from 80% 100% during the crisis.

As a result, Antioquia regional gross domestic product (“PIB” in Spanish initials) likely will come in at a net-negative 1.5% to 2% this year — barring some dramatic reversal, according to CCMA.

To get an idea of this impact, Antioquia’s GDP in December 2019 alone was COP$134 trillion (US$33 billion), according to CCMA.

“Of the 3 million employed persons in Antioquia department, close to 1 million work in activities at high risk of Covid-19, and losses of between 112,000 and 131,000 jobs are projected, which implies an increase in the unemployment rate close to 15%,” according to the trade group.

Because of quarantine rules to date, “55% of the companies in Antioquia are not currently operating. These represent 41.2% of formal jobs,” according to CCMA.

The controlled reopening of construction and manufacturing sectors on April 27 will help industry and employment — but won’t solve all the current problems, the group added.

What’s more, 88% of companies only have enough cash-on-hand to survive a maximum of one to two months, CCMA’s survey found.

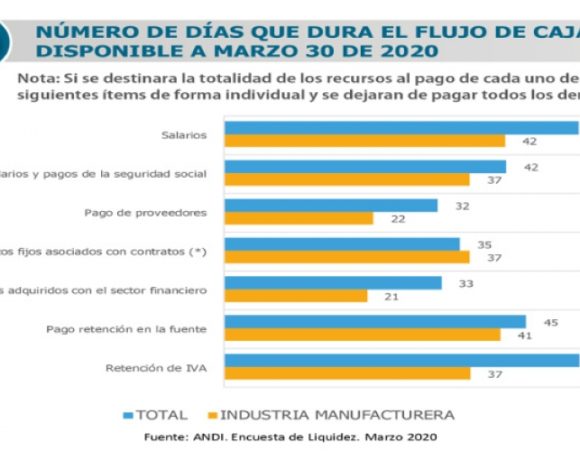

Meanwhile, ANDI – Colombia’s biggest national industrial/commercial trade association – on April 23 released findings of its second survey on cash liquidity among 238 member companies.

“Compared to the results of the previous survey, it can be seen that the liquidity situation of companies today with updated information as of April is more critical to the extent that the vast majority of companies have not received income and have had to continue to cover their expenses,” according to ANDI.

“In effect, with updated information, companies only have 11 days to operate if they allocate the entire cash flow of the company to fulfill all their obligations — that is, the entire payroll including social security, suppliers, financial sector, contracts and Dian [taxes].

“In the case of manufacturing companies, they have 12 days to operate” if cash-on-hand were disbursed to cover all outstanding expenses, ANDI found.

“In the manufacturing industry, there is an average of 42 days in cash to cover the salary of employees, 31 days to meet the full payroll including social security payments, 15 days to pay suppliers, 38 days to cover fixed expenses associated with contracts and loans acquired with the financial sector, 43 days for the payment of withholding tax and 42 days for the payment of VAT [value-added tax] withholding.

“However, the situation is much more complex for a large number of companies: 38.7% of the companies surveyed only have sufficient cash to cover between one and eight days if they meet all their obligations of payroll, suppliers, fixed expenses, financial sector and Dian, while 17.1% only have between nine and 15 days left, while 27. 6% have between 16 and 30 days. Thus, 83.4% have cash to operate for a month or less.”