Coronavirus-Slammed Businesses Reaching Critical Point on Cash Liquidity: ANDI

Colombia’s national industrial-commercial trade association ANDI on April 14 released results of a national member survey showing that Colombia’s business sector is close to hitting a critical wall on cash liquidity – because of the Coronavirus quarantine crisis.

The survey of 172 companies that collectively generated COP$56.8 trillion (US$14.7 billion) in operating income last year shows that “the liquidity situation of companies today is more critical to the extent that they have not received income and continue to cover their expenses,” according to ANDI.

“We have affirmed that the great problem at the moment is liquidity — that of individuals, that of the state [governments] and that of companies — the latter of which are the vehicles that generate employment and therefore income for millions of families,” added ANDI president Bruce MacMaster.

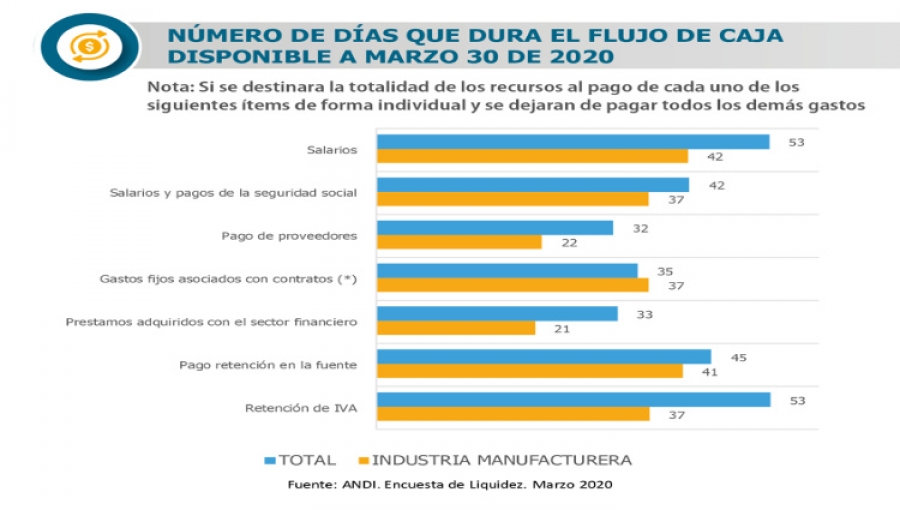

If companies simply were to resort to using 100% of cash-on-hand just to cover employee expenses — excluding all other costs, and not using bank overdrafts — then they would have just 53 days to cover the salary of employees or 42 days to meet the full payroll including social security payments, the survey shows.

If companies used all cash-on-hand instead just to pay outstanding bills to their suppliers, then they would have just 35 days to cover fixed expenses such as leasing of offices, premises, warehouses, machinery, insurance, maintenance, public services, security and others, the survey shows.

If companies instead used all current cash just to pay outstanding loans, then they would have just 33 days left.

If instead they used cash just to pay taxes to the national DIAN tax agency, then they would have 45 days to pay withholding tax and 53 days to pay value-added tax (VAT).

“In the manufacturing industry, the availability of cash resources is less,” according to ANDI. “There is an average of 42 days in cash to cover the salary of employees, 37 days to meet full payroll including social security payments, 22 days to pay providers, 37 days to cover the fixed expenses associated with contracts, 21 days for loans acquired with the financial sector, 41 days for the payment of withholding tax and 37 days for the payment of VAT withholding.

“However, the situation is much more complex for a large number of companies: 59.9% of the companies surveyed have cash flow of one-month-or-less to pay their employees’ payroll including social security, while 70.8% only have enough cash to pay suppliers and 69.2% only have enough to pay their fixed expenses associated with contracts,” the survey found.