Colombia Congress, President OK Tax-Reform Law; Could Boost Business Investment

Colombia’s House and Senate on December 28 voted to approve a wide-ranging tax-reform law, which won immediate approval from President Juan Manuel Santos.

The complete text of the new law is available here.

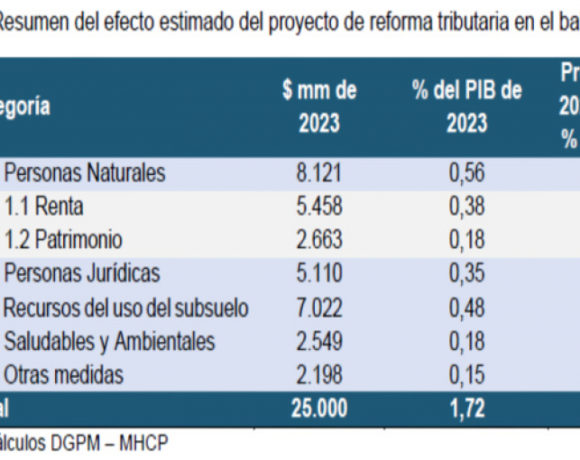

The new law is expected to generate an extra COP$6 trillion (US$2 billion) annually for the national treasury — partially compensating for a steep decline in government oil-and-gas taxes and royalties, which suffered because of the sharp global oil-price decline in the past two years.

The extra revenues should help Colombia retain a better credit rating, hence reducing borrowing costs, according to Home Minister Mauricio Cardenas.

According to Cardenas, the new tax-reform law also enables continuation of a wide variety of subsidies for 2.5 million of Colombia’s poorest people, as well as continuing subsidies for public education and certain other public services for the poor.

The biggest change in tax law boosts value-added tax (IVA in Spanish initials) to 19% — from 16% — for many items, but not all.

Of that new 19% rate, 0.5 percentage points will go to support Colombia’s vastly under-funded public health system, while another 0.5 percentage points goes for public education.

However, the Congress failed to approve a proposed tax on sugary beverages, which would have helped to reduce the huge fiscal deficit for the national health-care system. Trade associations representing small merchants vigorously opposed the measure, claiming it would hurt relatively low-income “mom-and-pop” corner stores.

Minister Cardenas claims that the new 0.5 percentage-point tax to support the national health system would improve health-care and cut waiting times, but hospital and health-care trade-associations fear that the measure won’t go far-enough to fix a huge fiscal gap.

Most food products as well as public utilities, public transport, medicines and school tuitions will continue to be exempt from IVA, under the new law. Certain personal-hygiene products, personal computers and cell-phones also will enjoy relatively modest 5% IVA taxes for normal uses.

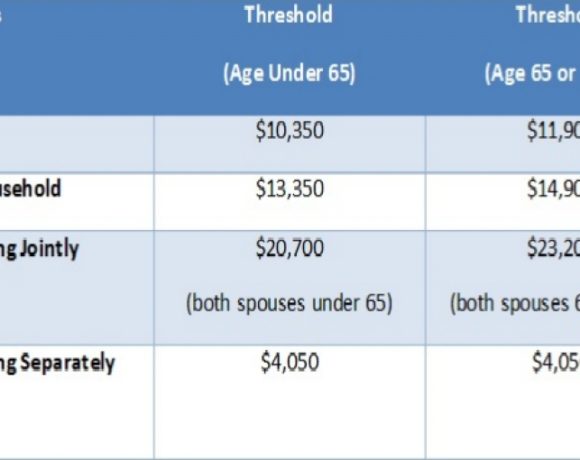

As for personal income taxes, Colombians making less-than COP$2.89 million (US$920) per month will be exempt, while those making more than that would pay on a graduating scale (see “Colombia’s Tax Reform Proposal: Better for Business, Investment,” Medellin Herald, October 20, 2016).

As for corporate tax rates, these will be cut to 37% initially and then fall to 33% in 2019, stimulating more investment and job creation, according to Minister Cardenas. Without the tax change, companies would have faced a 43% tax rate in 2018.

As for dividend earnings, a 5% tax will apply for those earning from COP$19 million (US$6,050) to COP$31.8 million (US$10,125), while those earning more than COP$31.8 million would pay a 10% dividend tax.

Although the new law abolishes the former “wealth tax” on certain wealthier individuals and companies, a temporary income surtax applies in 2017 (6%) and in 2018 (4%) but then disappears in 2019.

Meanwhile, companies operating in “zonas francas” (free-trade zones) will pay a 20% income tax.