Foreign Direct Investment in Colombia Grows Despite FDI Decline in LatAm

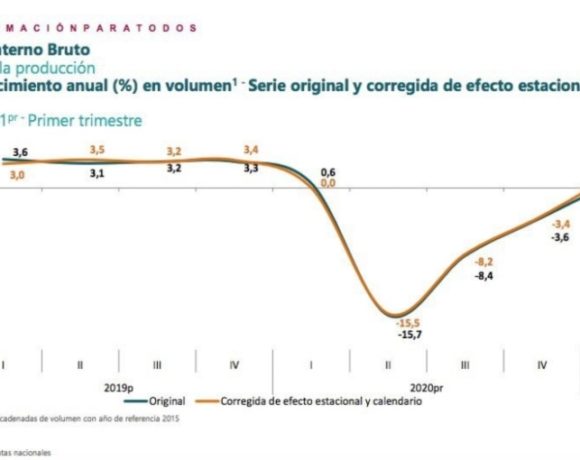

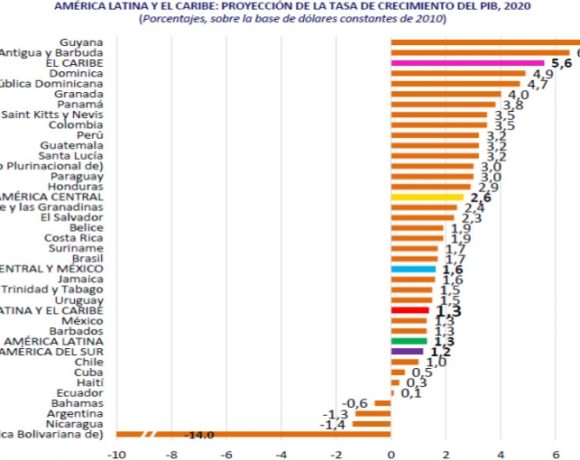

A new report from the United Nations Economic Commission for Latin America and the Caribbean (CEPAL) finds that foreign direct investment (FDI) in Colombia grew by a relatively modest 0.5% year-on-year in 2017, whereas FDI in Latin America actually fell 3.6% region-wide.

According to the report (see: https://www.cepal.org/es/comunicados/inversion-extranjera-directa-america-latina-caribe-cae-tercer-ano-consecutivo-2017-llega), “FDI inflows into Colombia reached US$13.924 billion in 2017, up 0.5% on 2016 levels and close to those recorded between 2011 and 2014.

“Reinvested earnings increased significantly for the year, especially in the fourth quarter, reflecting the increase in the price of oil, as well as the overall improvement of the economy in the second half of the year.”

Transport and telecommunications sectors were the biggest FDI recipients in 2017, at US$3.136 billion, “matching investment flows to the oil sector (US$3.135 billion), traditionally the largest recipient of FDI in Colombia,” according to the report.

Following the crash in global oil prices starting in 2014, “between 2011 and 2014, the oil sector [in Colombia] recieved over US$5 billion annually, but these [FDI] inflows halved in 2015 and 2016,” the CEPAL report noted.

In contrast, Colombia’s oil-and-gas FDI rise seen in 2017 and in the first months of 2018 “reflects the pick-up in investment resulting from the increase in [oil] prices,” according to the report.

Colombia’s mining sector also benefited from a global rebound in prices for basic materials, as 2017 mining FDI rose to US$953 million. “FDI in the manufacturing sector also increased, almost reaching its highest level in the past 10 years, at US$2.523 billion,” the report added.

Following a trend of recent years, Spain was the biggest single source of FDI to Colombia, at US$2.616 billion, with the United States a close second, at US$2.121 billion.

“Mexico was the third largest investor [to Colombia] in 2017 with FDI totaling US$1.717 billion, including an investment by Grupo Salinas, which injected an additional US$100 million into its fiber-optic infrastructure subsidiary, Azteca Comunicaciones Colombia,” according to the report.

“Investments from Spain and Mexico increased owing to the recapitalization of the [telecom] subsidiaries of Telefónica and Claro, after a Colombian court ordered the companies to pay the Colombian government US$500 million and US$1 billion [respectively] in compensation for contractual infringements in the framework of the concessions awarded to them in 1994,” the report added.

In contrast to the positive signs for Colombia, 2017 FDI actually declined 9.7% year-on-year in Brazil and 8.8% in Mexico, while Chile saw FDI plunge 48% and Peru dipped 1.4%.

Commenting on the CEPAL report, Maria Lorena Gutierrez, Colombia’s Minister of Trade, Industry and Tourism, stated: “Colombia is a stable country. We have instruments that attract investors such as investment agreements, free zones and double-taxation [avoidance] agreements.

“But the prospects are even better. The peace agreement [between the government and the FARC terrorist group] and the entry of Colombia into the Organization for Economic Cooperation and Development are aspects that make the country even more attractive,” she added.