New-Housing Sales Down This Year in Medellin, but Up in ‘Oriente,’ Envigado

In a November 8 presentation to some 1,000 attendees for an annual construction-industry forum here, Camacol Antioquia executive director Eduardo Loaiza revealed that new-housing sales in Medellin have fallen 31% this year – mainly due to recent economic weakness in Colombia and investor uncertainly over the national elections earlier this year.

Aside from now-settled election uncertainties that previously rattled investors and “paralyzed” construction, Loaiza cited relatively weak economic growth in Colombia (just 1.7% GDP growth last year and around 2.6% growth this year) as a key reason behind relatively feeble construction growth in Antioquia.

While forecasted GDP growth in Colombia is seen rebounding to around 3.5% in 2019, new tax proposals by the national government could present further headwinds for construction growth next year and beyond, he warned.

So far this year, total construction licenses in Antioquia have fallen 10% in 2018 versus 2017, with residential licenses down 10% and non-residential down 11%, he showed.

On the other hand, Camacol Antioquia calculations indicate that it’s possible that construction licenses here could rise to as much as 4 million square meters of occupied space in 2019, up from just 2.4 million square meters this year, he estimated.

From January through September 2018, total new-housing sales in Antioquia (including Medellin, the Aburra valley suburbs, plus the western and eastern suburbs and the Uraba region) fell 15% year-on-year, he showed. Sales of non-residential buildings in Antioquia also fell 13% this year versus last, he showed.

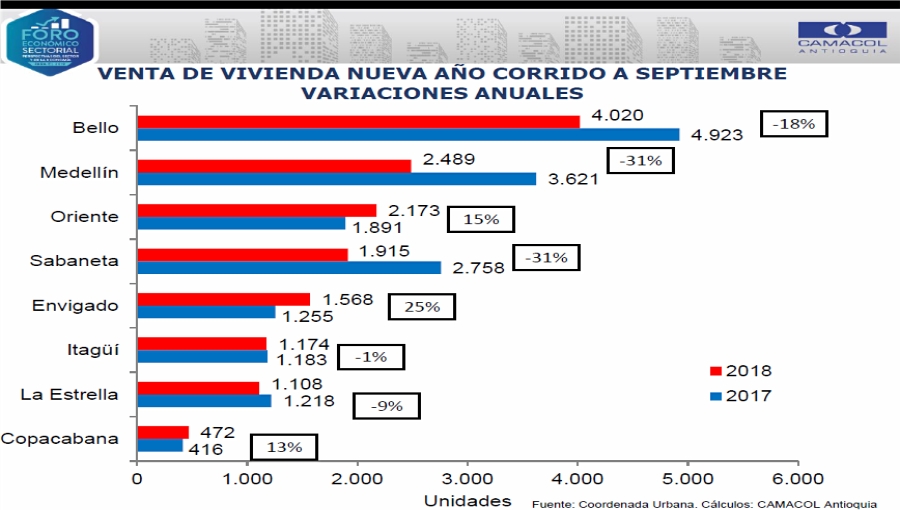

Other than Envigado — where 2018 new-home sales are up 25% this year versus last — the “oriente” region (east of Medellin including Rionegro, El Retiro, Llanogrande, San Antonio de Pereira and La Ceja) and the northern suburb of Copacabana were the only other regions or municipalities in Antioquia showing new-home sales growth: up 15% in “oriente,” and up 13% in Copacabana (see chart, above).

In contrast, sales in Medellin and Sabaneta both fell 31% this year, while Bello was off 18% and La Estrella down 9%, he showed. Homes available for sale in Antioquia also have declined 4.2% this year versus last, he showed.

On the other hand, Camacol estimates that sales of new houses in Antioquia in 2019 could rise about 7% year-on-year, to nearly 22,000 units, he said.

Meanwhile, on the hotel construction front, 19 new hotels were announced this year as in-development for Antioquia, nine of which are in Medellin and three in Rionegro, he showed.

In a separate presentation here, Camacol president Sandra Forero Ramirez explained that subsidized “social housing” has been the one segment of the construction market that has shown the greatest resilience through economic cycles — and this is the single-biggest market segment for housing construction growth, at 58% of the total.

In contrast, housing for middle-class and upper-income sectors have seen declines in construction over the past two years, she said. However, a Colombian national mortgage “stabilization fund” for housing construction has helped to slow the contraction in these markets, she added.

For 2019, Camacol expects continuation of more building in the subsidized “social housing” sector rather than in the middle and upper-income sectors.

So far in 2018, Colombia housing starts have fallen 7% year-on-year, she said. But that’s better than the 11% contraction in 2017, she pointed-out. Over-all Colombian housing demand also declined, to 155,000 units this year, compared to 170,000 in 2017, nearly 200,000 in 2016, and 180,000 in 2015.

Middle-income housing accounts for 30% of the total Colombian market, but demand in this sector could fall in 2019 if government interest-rate subsidies are trimmed. Construction in this sector has already fallen 14% this year, she showed.

Upper-income housing construction is 12% of the national market. This sector faces potentially devastating consequences in 2019 if the national government’s proposed 18% value-added tax (VAT) is imposed on all housing sales at or above COP$888.5 million (US$280,000 at today’s exchange rates) along with proposed curtailment of interest-rate deductions. Construction in this sector is already down 22% so far this year, she showed.

Velocity of housing sales also has slowed over the 2017-2018 period, with only 40% of newly constructed units sold within six months, compared to nearly 50% in the comparable 2016-2017 period. What’s more, only 55% of new units were sold within 12 months over 2017-2018, whereas 67% of new units were sold within 12 months during the 2016-2017 period.

The slowest sales rates are in the middle- and upper-income units; the fastest in the subsidized “social housing” sector, she showed.

In a separation presentation here, Victor Saavedra Mercado, Colombia’s Vice-Minister of Housing, stated that 4 million Colombians in urban areas continue to live in “inadequate” housing that may lack full water, sewer, gas and power utilities, lack legal property titles, occupy spaces that lack updated zoning, lack paved street access, and suffer from substandard building construction.

In total, some 44% of Colombians today live in rented housing, compared to 19% in Chile, 18% in Brazil, and 13% in Mexico and Peru, he said. Hence well-designed government programs could help a lot more lower-income Colombians move from renting to owning, he said.

To address this, new Colombian President Ivan Duque’s administration is putting more emphasis on subsidies for upgrading existing substandard housing, including rent-to-buy subsidy options, along with aid to municipalities that must update zoning to encourage investments, he said.

Construction: Huge Economic Engine for Antioquia

Antioquia accounts for 14% of Colombia’s entire gross national product (PIB), while the construction sector here by itself accounts for no-less-than 11.6% of Antioquia’s total GDP, Saavedra said — 6% of local PIB via buildings-construction, and 5.6% of local PIB in civil-works construction (roads, bridges, dams, airports), he explained.

While one-third of Antioquia’s population lives in rented housing, another 31% live in irregular housing and 35% are homeowners, he showed. Meanwhile, household formation (new marriages, new children) is running at a faster rate than new-housing construction, he warned. In addition, 80% of the municipalities in Antioquia lack updated zoning, which further complicates new-construction initiatives, he showed.

As for the densely-populated, densely-built land within Medellin, the city has now established plans to “renovate” 41% of its occupied lands with even higher-density housing, he showed.

Governor Perez Hails Tunnel Projects

In a final presentation here, Antioquia Governor Luis Perez cited several highway tunnel projects that will stimulate more residential and non-residential building in growing areas including Medellin’s suburban “oriente” region, the “occidente” region (around Santa Fe de Antioquia), the northern suburbs and (eventually) the Uraba region, once the “Mar 2” and “Toyo Tunnel” projects are completed during the next decade.

Some 74% of the total length of all new highway tunnels in Colombia are in Antioquia, Perez boasted. At least in Antioquia, tunnel construction is moving at a much faster pace than the long-delayed, vastly over-budget “Tunel de la Linea” tunnel strategically connecting Bogota to highways heading south-westward toward the Pacific port of Buenaventura, he bragged.

The “doble calzada oriente” project linking the Las Palmas highway east of Medellin to the Rionegro airport highway (see Medellin Herald August 1, 2018) only lacks one more bureaucratic approval before the project can be put-out for bid. Once built, this highway will attract even more construction investment to the “oriente” region east of Medellin, he added.

On another front, a proposed 19.9-kilometers-long highway linking the southern Medellin suburb of Caldas to the “oriente” municipality of El Retiro – including an 8.6-kilometers-long tunnel – is in “pre-feasibility” stage, he said. That new highway potentially could efficiently redirect much southern-Antioquia traffic bound for the “oriente,” which currently is forced to travel through Medellin to get there.

‘Colombian Property’ Sees Huge Growth Coming in Oriente

On a related front, El Retiro-based, bilingual real-estate agency specialist Colombian Property (www.colombianproperty.com) told Medellin Herald in a separate interview that “huge” housing growth is coming to the “oriente” region over the next five to 10 years — on top of tremendous growth over the past 10 years.

Colombian Property president Miguel Homsey – Colombian-born but New York-raised – pointed to the impact of new highways including the Tunel de Oriente linking Medellin to the international airport at Rionegro; the “doble calzada oriente” highway project between Sancho Paisa and the airport; the explosive growth of “parcelacion” gated community projects around El Retiro, Llanogrande, Rionegro and La Ceja; a newly proposed, upscale “wellness” retirement community project near La Ceja; a new highway that will link this area to Llanogrande and onward to Medellin; and future development of a second runway at the Rionegro international airport, triggering many more international flight connections.

“Foreigners are piling-in” to the oriente region thanks to its favorable climate, abundant “green” space, better air quality, relatively upscale neighborhoods and amenities, and a favorable dollar-to-peso exchange rate, he told us.

“El Retiro is going to change in a big way, with four to five thousand new luxury homes and apartments coming soon, and more properties coming later. There are 9,000 people living in El Retiro now but it’s going to double in population in the next few years.

“But people here don’t want to repeat the Sabaneta experience, where construction outran road and water infrastructure,” he said.

Asked about Colombian Property’s market focus, “we try to focus on certain mid-to-high-range properties in certain locations. We have a bilingual lawyer available to help the process, and an accountant that helps with certain documents, advice on doing foreign money transfers here, and the Colombian investor-residency process,” Homsey added.